A short number of years ago, no one in his right mind would have associated the term “fortress balance sheet” with Bank of America. During the financial crisis, Bank of America was forced to accept a massive $45 billion bailout from the U.S. Treasury. As the financial system imploded during 2008 many people wondered if […]

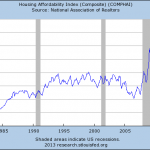

The Average Family Can Now Afford To Own Two Houses

The combination of all time lows in mortgage rates along with the collapse in real estate values has resulted in all time record housing affordability. During the inflation racked 1980’s, interest rate increases by the Federal Reserve resulted in double digit mortgage rates. High mortgage payments froze most home buyers out of the housing market […]

FHA Reverse Mortgage Losses Of $28 Billion – Profits For Banks, Disaster For Borrowers and Taxpayers

Reverse mortgages have become the new minefield in government sponsored mortgage lending. According to an independent estimate done for HUD, losses could exceed $28 billion through 2019. To put that figure into perspective, total losses to the FDIC Deposit Insurance Fund for the 51 banking failures of 2012 total only $2.5 billion. The good news […]

FHA Loans Immediately Put Borrowers Into A Negative Equity Position

In a speech given at the Brookings Institution, Brian Moynihan, CEO at Bank of America, said “We need to look hard at some of the old assumptions and ask the question is homeownership the right solution for everyone?” Moynihan went on to cite the Federal Housing Administration (FHA) as an example of what is wrong […]

Bank Earnings Soar To Six Year High But Bank Stocks Still Off 50% From Pre Crisis Levels

According to the latest FDIC Quarterly Banking Profile, the banking industry recorded its 13th consecutive quarterly year-over-year increase in profits. Total net income for all FDIC-insured institutions rose to $37.6 billion in the third quarter of 2012, a 6.6% increase from the third quarter of last year. Most of the increase in net earnings were […]

Mortgage Borrowers Pay Thousands In Excess Fees Due To Complex Bank Pricing

Few people wonder if they got the best price on that newly purchased 65” HDTV. Transparency in retail pricing through technological advances has enabled consumers to quickly locate the retailer selling a product at the lowest cost. A few quick clicks on the web or the use of price comparisons apps such as Amazon’s “Price […]

Secrets of The Federal Reserve Visually Explained

The Federal Reserve has virtually unlimited power over the economic future of America yet few people know much about it. Is the Fed saving or destroying America? Here’s a neat history of the Federal Reserve published by Mint.com. by Mint.com.Learn about infographic design.

Regulators and Government Activism Are Prolonging The Housing Crisis

Banks never seem to learn as they lurch from one lending crisis to the next. In the early 1970’s the largest banks in the country lent recklessly to Latin American countries under the theory that sovereign nations would not default. The ensuing Latin American debt crisis and sovereign defaults shattered that complacent theory and many […]

Connecticut Home Values Plunge As Banks Cut Jobs And Bonuses

Banking industry woes are translating into major price declines for high end residential real estate in Connecticut. For those who believe that real estate prices has bottomed out, please consider Connecticut Homes Biggest Losers As Wall Street Cuts. Prices in the Fairfield County area, home of the banker bedroom communities of Greenwich and New Canaan, […]

Doubts Remain Over Banking Industry “Recovery” – FDIC Quarterly Banking Profile

The banking industry, which was on the verge of collapse in 2008, is showing tenuous signs of recovery. The FDIC Quarterly Banking Profile for the quarter ending June 30, 2012, showed an increase in both bank profits and lending volume as well as a small decline in the number of problem banks. Almost 63% of […]