According to the latest FDIC Quarterly Banking Profile the number of problem banks continued to decline for the quarter ending December 31, 2014. After reaching a peak of 888 at the end of the first quarter of 2011 the number of problem banks has declined for 15 consecutive quarters. The number of problem banks is […]

Over 8,500 Banks Have Disappeared Since 1990 – “Too Big to Fail” Remains a Banking Reality

The latest FDIC Quarterly Banking Profile highlights the sharp decline in the number of banks over the past 24 years. For the quarter ending September 30, 2014 the number of FDIC insured institutions totaled 6,589 down by 56 percent from a total of 15,158 in 1990. Since December 1998 the number of banks has dropped […]

Bank Failures Fall to Seven Year Low

During the financial crisis the number of banking failures swelled to a peak failure year during 2010 when a total of 157 banking institutions failed. The number of bank failures has declined every year since then and the number of banks failures during 2014 has reached a seven year low. Is the current low number […]

Would Bank Living Wills/Resolution Plans Actually Help Resolve the Next Banking Crisis?

The public portions of the annual resolution plans or living wills of 17 large financial institutions were jointly released by the FDIC and the Federal Reserve Board today. The resolution plans describe in detail a financial institution’s plans for a rapid and orderly resolution under the U.S. Bankruptcy Code to address material financial distress or […]

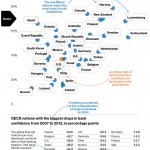

Most Americans Still Don’t Trust Banks and Here’s Why

Six years after the near melt down of the United States banking industry in 2008, more than half of all Americans still lack confidence in both the banking system and the government. Interestingly the United States with some of the biggest banking institutions in the world and the implicit backing of the United States Treasury […]

FDIC Slashes Operating Budget By 11% Citing Recovery In Banking Industry

The continuing recovery of the U.S. banking industry means less work for the agency primarily responsible for the safety and soundness of the nation’s banks and savings associations. Due to the decline in banking failures and resolution receivables, the FDIC announced today that their operating budget for 2014 will decline by 10.9% to $2.39 billion. […]

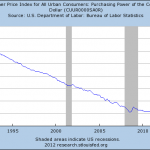

What a Collapsed Banking System Looks Like

In the 1930’s the collapse of the banking system propelled the world into an economic collapse. Depositors lost their savings, confidence was shattered, companies starved for capital went out of business overnight, borrowers defaulted en masse and unemployment soared. A collapsed banking system guarantees an instant economic depression. A mere generation later, the world is […]

2012 Bank Failures Lowest Since 2008 As Regulators Close 51 Banks

During the past five years we have witnessed the greatest financial turmoil since the Great Depression. Hundreds of giant bank failures rocked the nation, real estate values crashed, trillions of dollars of wealth vanished overnight and millions of Americans lost their jobs. Although a relative calm has been restored due to unprecedented actions by both […]

Owning Bank Stocks Might Be Better Than Keeping Cash In The Bank

The financial meltdown that began five years ago resulted in widespread financial devastation for millions of Americans. Retirement and stock portfolios were decimated while real estate values declined by 50% or more in many parts of the country. The American middle class was shocked as trillions of dollars of wealth suddenly disappeared. The collapse of […]

Bank Earnings Soar To Six Year High But Bank Stocks Still Off 50% From Pre Crisis Levels

According to the latest FDIC Quarterly Banking Profile, the banking industry recorded its 13th consecutive quarterly year-over-year increase in profits. Total net income for all FDIC-insured institutions rose to $37.6 billion in the third quarter of 2012, a 6.6% increase from the third quarter of last year. Most of the increase in net earnings were […]