The financial meltdown that began five years ago resulted in widespread financial devastation for millions of Americans. Retirement and stock portfolios were decimated while real estate values declined by 50% or more in many parts of the country. The American middle class was shocked as trillions of dollars of wealth suddenly disappeared.

The collapse of financial institutions was so widespread that people doubted the ability of the FDIC to protect trillions of dollars of consumer savings in the banking system. As it turned out, massive aid by the government to the banking industry prevented a total collapse of the system and depositors with savings insured up to the FDIC limits did not lose a dime of their deposits.

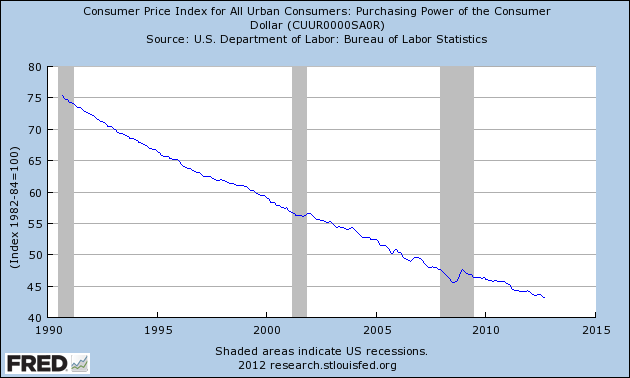

An unfortunate side effect of the government’s effort to revive the economy with low interest rates, however, is now decimating savers who are earning near zero interest rates. Factor in the impact of 3% inflation and savers are now losing purchasing power by keeping their money in the bank. For those who cannot tolerate potential large fluctuations in the principal amount of their savings, losing 3% or more of their savings each year by keeping money in the bank may represent a “fair” trade off. Long term, however, if interest rates remain low and inflation increases, the “safe” strategy of keeping savings in the bank is the perfect recipe for the destruction of wealth as can be seen the chart below.

The purchasing power of the dollar since 1990 has declined at a precipitous rate. Before the Federal Reserve instituted its zero interest rate policy, savers could offset some of the lost purchasing power by collecting interest on their savings, but those days are gone. If the U.S. follows the path of Japan, which has had near zero interest rates for almost two decades, bank savers will wind up in poverty as the purchasing power of their money disappears. Saving money in the bank, which appears to be a “safe bet”, may wind up being a catastrophic strategy for wealth preservation.

One ironic solution for bank depositors may be to invest in bank stocks. Bank stocks experienced one of the greatest collapses of values in stock market history from 2007 to 2009. Many investors suffered declines of 90% or more in the value of their bank stocks and many more were completely wiped out as hundreds of banks failed.

As measured by the KBW Bank Index, the value of banking stocks declined by almost 85% from 2007 to the lows of 2009. As it became apparent that the financial system was not going to collapse, bank stocks almost tripled from the panic lows of 2009. For the past two years, the bank stock index has moved sideways and is now approaching a potential breakout as can be seen in the chart below.

Not all banks engaged in risky lending practices or excessive leverage. Many sound banks have taken advantage of the financial crisis to gain market share and deposit growth. In a post earlier this year, five mutual savings banks were discussed that looked like good investments. Since that time, a portfolio of these five stocks has increased by about 16%. In addition, all five of these banks pay a dividend far in excess of current deposit rates.

Not all banks engaged in risky lending practices or excessive leverage. Many sound banks have taken advantage of the financial crisis to gain market share and deposit growth. In a post earlier this year, five mutual savings banks were discussed that looked like good investments. Since that time, a portfolio of these five stocks has increased by about 16%. In addition, all five of these banks pay a dividend far in excess of current deposit rates.

Things always change. Although bank stocks were the worst possible place to be invested in 2007, they may now be a good mechanism for wealth preservation, income and growth.

Speak Your Mind

You must be logged in to post a comment.