The European banking crisis intensified as the threat of debt default contagion spread across Europe. What was once a “Greek” problem has quickly overwhelmed all of Europe, resulting in a broad sell of equities and frozen credit markets. Bloomberg reports that European banks are now being valued at levels last seen during the worst of […]

European Banking Crisis Spins Out Of Control – Officials Have No Solutions

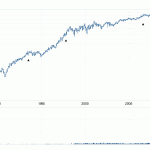

Downward Spiral Of Bank Stocks Is Predicting An Economic Crisis

After rallying last fall, many of the big bank stocks have seen substantial declines from the beginning of the year. Growing fears about the health of the banking industry are discussed in the latest Economics and Mortgage Market Analysis issued by Fannie Mae. Fannie Mae cites a very weak housing market and an economic slowdown […]

The FDIC Has A Problem With Bank Of America’s Proposed Dividend Increase

Speaking at Bank of America’s first investor conference since 2007, Chief Executive Brian Moynihan told shareholders that he was focused on increasing shareholder returns through share buybacks, special cash dividends and increased regular dividends. Mr. Moynihan also cheered investors on by predicting that Bank of America could earn, under normal business conditions, up to $40 […]

Warren Buffett Bullish On Wells Fargo – Stock Price Unchanged For 10 Years

If you want to invest in bank stocks, legendary Warren Buffett says buy Wells Fargo. Wells Fargo, the fourth largest bank holding company in the United States with $1.22 trillion dollars in assets emerged from the financial crisis in far better shape than many of its large competitors. The management team at Wells avoided high […]

FDIC Says Dodd-Frank Act Ends “Too Big To Fail” Era

September 3, 2010 – FDIC Chairman Sheila Bair, in testimony before the Financial Crisis Inquiry Commission discussed how future systemic risks can be better managed and reduced under provisions of the Dodd-Frank Act. Chairman Bair also said that new liquidation authority under the Act is a fundamental factor that will allow the U.S. to end […]

FDIC Chairman Says Critical Financial Reforms Needed

In remarks to the International Institute of Finance, FDIC Chairman Sheila Bair cited the need for critical financial reforms that combine stronger regulation and market discipline. Ms. Bair stated that the “first task” should be to scrap the “too big to fail” doctrine by establishing a new resolution mechanism to handle the failure of large […]

FDIC Sheila Bair – “Too Big To Fail Creates Enormous Risk”

Too Big To Fail Doctrine Needs To Be Abandoned FDIC Chairman Sheila Bair, in a speech at Georgetown University, outlined her plan for a better regulated financial system based on market discipline and ending the “too big to fail” concept. Chairman Bair’s viewpoint is that the doctrine of “too big to fail” rewards mismanagement and […]

Will “Too Big To Fail” Banks Crash The Financial System?

Why The Biggest Banks Are Too Big To Fail The “too big to fail bank” issue has been debated ever since the financial meltdown of 2008 brought many of the mega banks to the brink of financial collapse. The government’s recent moves to strengthen its financial regulatory powers over financial institutions has brought to center […]

FDIC’s Bair Says Problem Banks Not Viable Should Fail

Failure Should Not Be Rewarded FDIC Chairman Sheila Bair set forth guidelines today for establishing a Financial Company Resolution Fund (FCRF) to deal with the failure of systemically significant institutions. Regulations alone are insufficient to control risk in a complex and dynamic financial system. Events of the past two years have shown, despite extensive regulatory […]