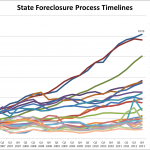

According to Micheal Olenick, founder of FindtheFraud, the worst of the housing crash and banking crisis still lies ahead of us. Mr. Olenick’s excellent in depth analysis discusses the multiple factors that are prolonging the foreclosure crisis and explains how banks and servicers are trying to delay taking losses that could eventually reach a staggering […]

Widespread Banking Failures Predicted As Housing Values Continue To Plummet

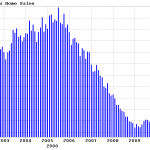

Total 2011 Foreclosure Filings Reach 2.7 Million – Expect 2012 To Be Worse

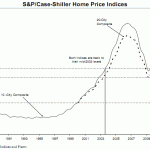

Fed Chairman Ben Bernanke must be talking to himself by now. Despite driving interest rates to zero and the expenditure of trillions of dollars to prop up the housing market, home prices declined again in 2011. The most recent data on foreclosure activity makes it clear that the Fed’s efforts to date have accomplished next […]

Housing Prices Have Crashed So Much You Can Buy One With A Credit Card

Home prices continue to plunge in value. According to the latest statistics from S&P/Case-Shiller, prices declined by over 1% in October. The crash in housing prices has now brought prices back to levels last seen in 2003. Each local housing market is unique with some states such as Florida and Nevada experiencing much greater price […]

Banking News – Daily Banking Update

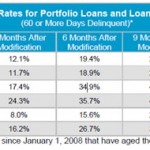

Welcome to Banking Update, a roundup of articles and news from around the Internet. The government keeps trying new foreclosure programs despite the failure of previous ones, homeowners past due by more than 60 days are unlikely to recover, home prices continue to drop, mortgage fraud continues and almost half of all home purchases are […]

Mortgage Default Is A Financial Bonanza For Many Homeowners As Foreclosure Crisis Continues

The Office of the Comptroller of the Currency (OCC) painted a gloomy picture for the housing markets with its release of the OCC Mortgage Metrics Report for the third quarter of 2011. Mortgage delinquencies remain at high levels and foreclosures increased by double digits. The OCC report covers mortgages serviced by federal savings associations and […]

Net Worth of American Households Plunges By $2.4 Trillion In Third Quarter

Those looking for a rebound in either real estate prices or the wealth of the American consumer were sorely disappointed after the release of the Federal Reserve’s Flow of Funds Accounts for the third quarter 2011. The net worth of Americans plunged by $2.4 trillion in the third quarter. Keep in mind that the entire […]

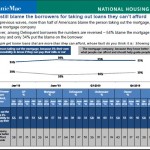

Who Is To Blame For Borrowers Taking Loans They Can’t Afford?

Ever since the mortgage crisis started in 2008, there has been a wide divergence in opinions on who was to blame for borrower defaults. Many blame greedy bankers who abdicated sound underwriting principles for financial gain by approving mortgages for unqualified borrowers. Others blame the borrowers themselves for being irresponsible and taking on debt that […]

HAMP Foreclosure Program Called “A Colossal Failure”

Republican Representative Jim Jordan of Ohio has introduced legislation to end the Home Affordable Modification Program (HAMP), calling it a “colossal failure.” The HAMP program was the showcase of the Obama administration’s plan to stop foreclosures by modifying mortgages to a payment level that was affordable for distressed homeowners. It was originally estimated that HAMP […]

Housing Market On Critical List As Sales Plunge and Strategic Defaults Loom

The latest news on housing remains distressing and points to continued depreciation in home values. New Home Sales Plunge Again – The Census Bureau and the Department of Housing and Urban Development released figures showing that the number of new homes sold in 2010 totaled only 321,000 – the lowest reading in 47 years. The […]

FDIC Chief Condemns Mortgage Servicers While Ignoring FDIC Role In Mortgage Crisis

In a strongly worded speech at the Summit On Residential Mortgage Servicing For the 21st Century, FDIC Chief Sheila Bair condemned the mortgage servicing industry for their role in extending the mortgage crisis. Ms. Bair stated that the housing industry has been stabilized by emergency measures but that the effects of the housing bust and […]