Fed Chairman Ben Bernanke must be talking to himself by now. Despite driving interest rates to zero and the expenditure of trillions of dollars to prop up the housing market, home prices declined again in 2011.

The most recent data on foreclosure activity makes it clear that the Fed’s efforts to date have accomplished next to nothing.

The foreclosure statistics for 2011 from RealtyTrac reveal the disastrous state of the U.S. housing market.

RealtyTrac® (www.realtytrac.com), the leading online marketplace for foreclosure properties, today released its Year-End 2011 U.S. Foreclosure Market Report™, which shows a total of 2,698,967 foreclosure filings — default notices, scheduled auctions and bank repossessions— were reported on 1,887,777 U.S. properties in 2011, a decrease of 34 percent in total properties from 2010. Foreclosure activity in 2011 was 33 percent below the 2009 total and 19 percent below the 2008 total.

“Foreclosures were in full delay mode in 2011, resulting in a dramatic drop in foreclosure activity for the year,” said Brandon Moore, chief executive officer of RealtyTrac. “The lack of clarity regarding many of the documentation and legal issues plaguing the foreclosure industry means that we are continuing to see a highly dysfunctional foreclosure process that is inefficiently dealing with delinquent mortgages — particularly in states with a judicial foreclosure process.

“There were strong signs in the second half of 2011 that lenders are finally beginning to push through some of the delayed foreclosures in select local markets. We expect that trend to continue this year, boosting foreclosure activity for 2012 higher than it was in 2011, though still below the peak of 2010.”

Although the foreclosure rate for 2011 was the lowest since 2007, the residential real estate market is far from reaching equilibrium due to the vast overhang of delayed foreclosures. In addition, there is an estimated four million mortgages that are delinquent by 90 days or more and heading towards foreclosure. Compounding the problem further are the 12 million homeowners trapped in a negative equity position who may ultimately chose to strategically default.

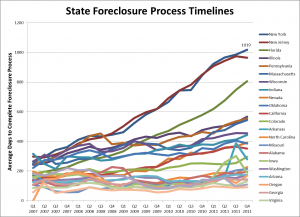

The RealtyTrac report shows that the length of time it takes for a foreclosure action to be completed has increased significantly. New York and New Jersey, which employ a judicial foreclosure process, are virtually tied for first place with foreclosure actions taking approximately 1,000 days or almost 3 years (see Mortgage Default Is A Financial Bonanza For Many Homeowners). Texas has the shortest foreclosure process with completion in about 90 days.

The negative feedback loop of delinquencies and foreclosures that lead to further distressed property sales causing further declines in home prices which in turn cause more delinquencies and more foreclosures is resulting in a perpetual cycle of destruction for the banking industry and American homeowners.

In an interview in CNNMoney, Laurie Goodman, a mortgage backed securities analyst, summed up the housing mess with the bleak warning of a housing “death spiral.”

On top of the 2.5 million homes that have already fallen to foreclosure since the bubble burst, another 4.5 million mortgage holders have given up and are likely to lose their homes. Millions more are underwater – owing more than their home is worth – and may give up soon. All told, Goodman warns that more than 10 million of the nation’s 55 million mortgage holders could default by 2018. If home prices fall much more than the 6% or so she’s projecting over the next 12 to 18 months, the picture worsens, as more foreclosures drive prices down further, in turn causing more sheriff’s sales.

The banking industry, barely starting to recover after the financial crisis of 2008 and the ongoing housing meltdown, cannot survive another catastrophic increase in defaults.

Speak Your Mind

You must be logged in to post a comment.