Welcome to Banking Update, a roundup of articles and news from around the Internet. The government keeps trying new foreclosure programs despite the failure of previous ones, homeowners past due by more than 60 days are unlikely to recover, home prices continue to drop, mortgage fraud continues and almost half of all home purchases are for cash. On to the links:

Foreclosure relief programs such as HAMP, HARP and Hope for Homeowners have all been a failure in preventing foreclosures. The latest plans by the OCC to help homeowners will also likely be a failure according to some critics who claim that “Not only will it not help people, it could easily harm them.”

Most homeowners who fall behind in the mortgage by more than 60 days find it impossible to bring the payments up to date. Some options to explore for keeping your home are examined by the New York Times. Distressed homeowners should be very skeptical of the claims of many “mortgage mod” companies who claim that they can resolve your problems for an upfront fee since many of these companies engage in fraudulent or deceptive practices.

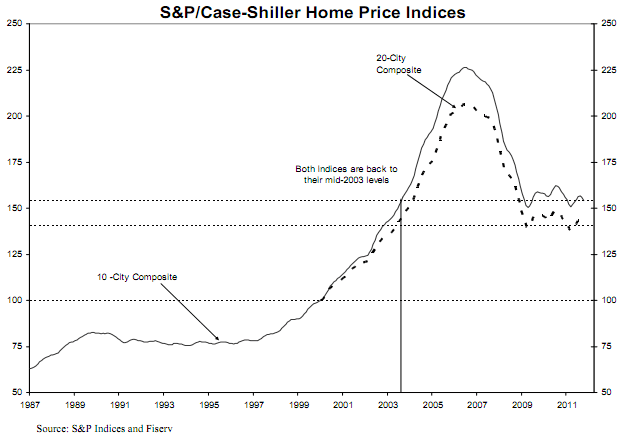

Home prices continue to drop according to the latest numbers from Case-Shiller. Home prices have now collapsed back to the levels of 2003.

Mortgage fraud continues despite the implementation of many new rules and regulations. The latest scam involves realtors, appraisers and buyers colluding to purchase and quickly flip houses purchased as short sales from the banks. The homes are bought at prices far below fair market value based on fraudulent appraisals according to National Mortgage News.

Despite record low interest rates, almost 40% of all home purchases were done for cash. Investors account for a significant number of home purchases as traditional home buyers remain reluctant to purchase.

Politicians excel at finding someone – anyone to blame for problems, while denying their own culpability. Was the banking industry or the government to blame for the housing crash and financial crisis – Barney Frank gives us his input on who caused the housing crash.

Over 400 banks borrowed vast amounts of money from the Fed during the financial meltdown. Bloomberg releases spreadsheets that show exactly who borrowed how much.

Bank of America debt collector harassed widow for debt of deceased husband.

That’s it for today – have a great evening!

Will the banks make other deals like if you want to move to another state you sign one house over to them and they finance another home for you.Fresh start

You would think this makes sense but the legalities of it would require selling and paying off the mortgage on your current house first and then purchasing another in a separate transaction.

The reason everyone is paying in cash right now (despite record rates) is because banks and even credit unions wont loan money to people with anything near average credit. My non-profit credit union requires a minimum of 720 to get a home loan.