Those looking for a rebound in either real estate prices or the wealth of the American consumer were sorely disappointed after the release of the Federal Reserve’s Flow of Funds Accounts for the third quarter 2011.

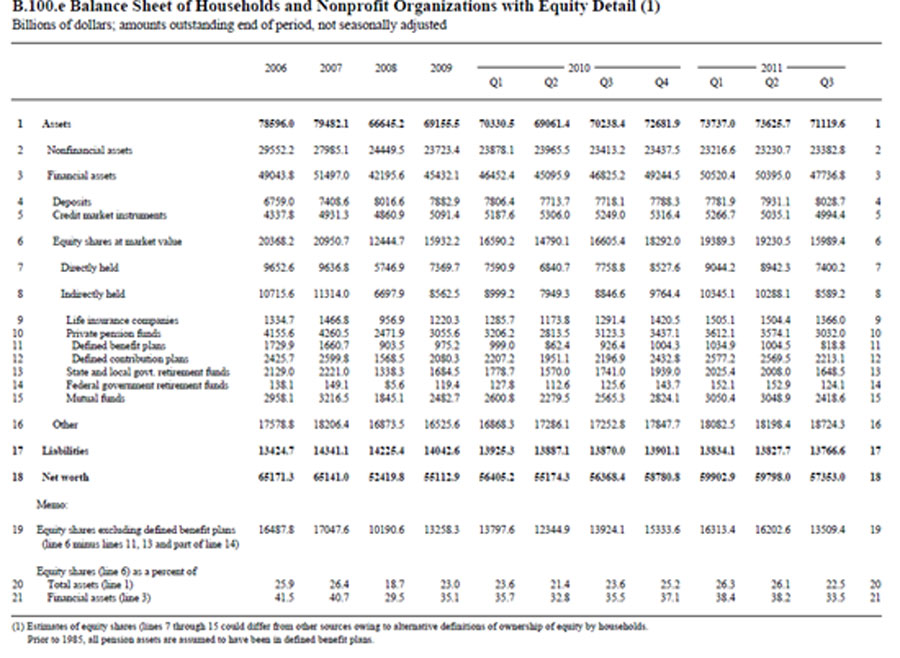

The net worth of Americans plunged by $2.4 trillion in the third quarter. Keep in mind that the entire gross domestic product of the United States is about $15 trillion. Losing $2.4 trillion in wealth is equivalent to losing over 16% of the entire amount of goods and services produced by the entire country over the past year.

Even more unsettling than the latest quarterly figures on wealth destruction is the amount of wealth that has been vaporized in the past four years. The net worth of American households peaked in 2007 at $66.8 trillion. As of September 30, 2011, the net worth of American households had plunged to $57.4 trillion for a loss of $9.4 trillion. To put these number in perspective, this is a loss of net worth per person in the United States of $30,618. A family of four is statistically poorer by $122,472 than they were in 2007.

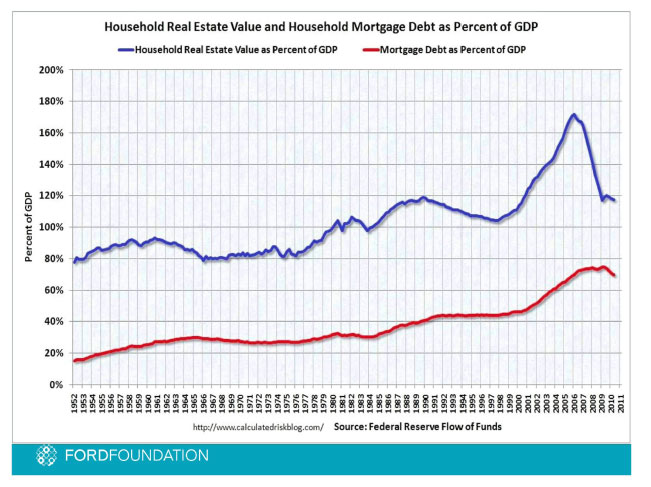

The value of real estate owned by American families has dropped $6.6 trillion since peaking in 2007 and continues to drop. In the latest quarter, the value of household real estate dropped by $98 billion. Charts from the Federal Reserve website show the destruction in values that has occurred since 2007.

The latest numbers from the Federal Reserve forecast further stress on both homeowners and the banking system. We are now dealing with the worst part of the aftermath of collapsed real estate prices. Even as housing values have plunged, the debt incurred during the housing bubble remains.

Most American households remain mired in debt and almost 11 million households are in a negative equity position, owing more in mortgage debt than their house is worth. Although mortgage debt has declined by over $700 billion since the peak in housing prices, most of the decline is due to foreclosures rather than the paying down of debt.

Speak Your Mind

You must be logged in to post a comment.