The recent Massachusetts Supreme Court ruling against Wells Fargo and U.S. Bancorp is likely to bring foreclosures to a crawl, resulting in a further destabilizing of housing markets. The Court ruling is a major win for debtors and a severe blow for creditors trying to clear a backlog of millions of defaulted mortgages. The Massachusetts […]

Court Ruling Against Bank Foreclosures Could Spiral Into Full Blown Financial Crisis

The Compelling Case For A New Wave Of Mortgage Defaults And Bank Failures

Two new reports make a compelling case that the markets have not fully discounted the probability of another flood of residential foreclosures precipitated by the continuing decline in home values. The potential impact of price depreciation on the quality of loan portfolios casts serious doubt on the notion of a long term profit recovery for […]

Oversight Panel Blasts Treasury For Loan Modification Failure

December 15, 2010 – The Congressional Oversight Panel (COP) was created by Congress during the height of the financial crisis to oversee the handling of $700 billion given to the US Treasury to stabilize the U.S. economy. Part of COP’s responsibility is to issue regular reports on the Treasury’s actions and to guarantee that Treasury’s […]

Banks May Be Facing A Tidal Wave Of Mortgage Defaults

Although bank stocks have rallied recently, it may be premature to expect a recovery for the banking industry. There are multiple indicators that a housing recovery is little more than a distant dream and current trends suggest that mortgage defaults may increase substantially. With banks currently holding approximately $3 trillion dollars in residential mortgages, […]

FDIC’s Bair Says Real Estate Crucial To Entire Economy – $3.5 Trillion In Mortgages At Risk Of Default

October 13, 2010 – Can the economy improve without a recovery in real estate values? This question was addressed today by FDIC Chairman Sheila Bair, in a speech to the Urban Land Institute in Washington, D.C. Despite optimistic forecasts by various analysts, Ms. Bair cited the daunting challenges that must be overcome in order to […]

Big Banks Accused Of Promoting Predatory Payday Lending

September 15, 2010 – Big banks seem to be on the nation’s list of most hated institutions. After being blamed for causing the financial crash of 2008 through reckless lending, banks are now taking heat for prolonging the recession with excessively stringent lending standards. One industry to which banks have aggressively extended credit is now […]

Should Banks Be Allowed To Resume Subprime Lending?

As discussed in a previous post, based on the total number of Americans with a credit score of 649 or lower, up to 35% of all Americans are effectively locked out of the refinance or purchase mortgage market for the foreseeable future (see One Third of All Americans Unqualified). In the past, borrowers who did […]

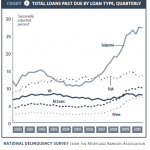

Delinquency Report Suggests Future Increase In Mortgage Defaults

August 28, 2010 – The newly released Delinquencies and Foreclosure report by the Mortgage Bankers Association (MBA) largely mirrors the Federal Reserve Bank of New York’s quarterly report on household debt and credit. The mortgage delinquency rate for one to four unit residential properties decreased slightly to 9.85% and the percentage of loans in foreclosure […]

One Third Of All Americans Unqualified For A Mortgage

August 24, 2010 – According to research from Deutsche Bank, the number of Americans with credit scores below 600 has increased to 26% from only 15% prior to the start of the recession. Further examination of credit data reveals that 9% of all Americans have a credit score in the 600-649 range. Based on current […]

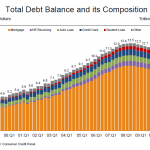

Consumers Delinquent On $1.3 Trillion Of Debt

August 23, 2010 – Banks nationwide have seen a staggering increase in delinquencies and nonperforming loans as the result of a severe economic recession and housing collapse. Although delinquency rates and defaults are still at horrendous levels, the Federal Reserve Bank of New York’s quarterly report on household debt and credit offers hope that defaults […]