The latest news on housing remains distressing and points to continued depreciation in home values.

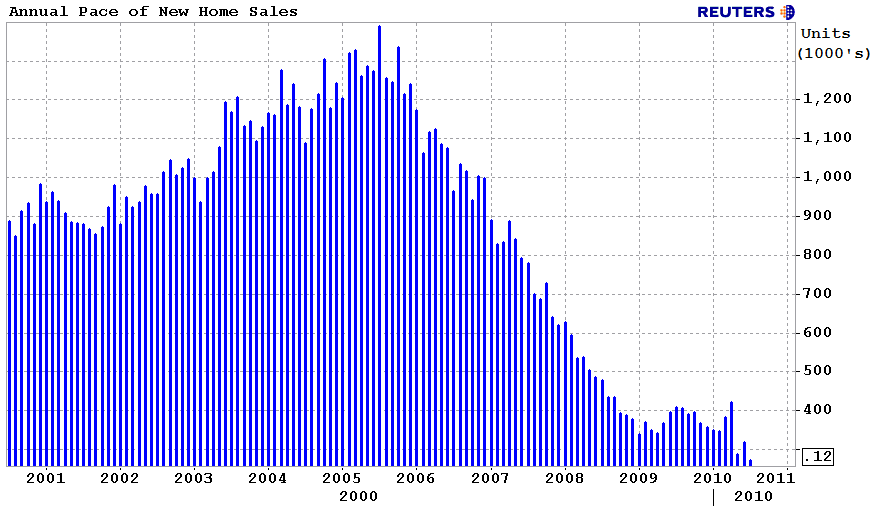

New Home Sales Plunge Again – The Census Bureau and the Department of Housing and Urban Development released figures showing that the number of new homes sold in 2010 totaled only 321,000 – the lowest reading in 47 years. The 2010 figures represent a decline in sales of 14.4% from 2009. The 2010 new home sales figures represent the fifth consecutive year of declining home sales.

The government new home sale stats did contain some small measure of good news as the inventory of new homes in December fell to 6.9 months compared to 8.4 in the previous month. The seasonally adjusted annual rate of sales peaked at 414,000 in April as the tax credit for new home purchases expired.

Home Prices Continue to Decline According to S&P/Case-Schiller Home Price Index – The latest survey for home prices show continued price erosion nationally and in 17 of the 20 areas tracked by the Index. Prices fell by 1.6% in November for the composite index that tracks 20 metropolitan areas.

Chairman of the S&P Index Committee, David Blitzer, noted “The series are now only 4.8 percent and 3.3 percent above their April 2009 lows, suggesting that a double-dip could be confirmed before spring. Certainly eight cities setting new lows, and with the only positive news concentrated in southern California and Washington DC, the data point to weakness in home prices.”

Since the peak in housing prices in mid 2007, prices in the index areas have declined by a stunning 30%. Markets that have experienced the most devastation include Phoenix, down 54%, Las Vegas, down 57%, and Miami, down 49%.

Will Falling Prices Become Self Perpetuating? – Falling home prices seem to be causing a negative feedback loop as potential purchasers decide to postpone a purchase until prices stop falling.

It is psychologically devastating for a new home buyer to see a hard earned down payment vaporized shortly after purchasing a home. Most buyers will prefer to wait until an uptrend in housing prices can be seen, thus putting further pricing pressure on the housing market as demand shrinks.

Despite throwing trillions of dollars at the problem, the government has not been able to do much more than slow the decline in home prices. Mortgage rates, close to all time lows, have also done little to entice new home buyers. Foreclosure inventories are forecast to increase this year as the grim restructuring in housing continues. It should come as no surprise that most potential home buyers have concluded that waiting to buy is the safest option.

Mortgage Bankers Association (MBA) Forecasts Slowdown – The perpetually optimistic MBA finally adjusts to reality and predicts lower refinances and purchases. In 2010, approximately $1.6 trillion in new mortgages were funded, including refinances and purchases. The MBA is forecasting fundings of only approximately $1 trillion for each of the next two years.

Almost Half of Americans See No Problem With Defaulting On Their Mortgage – A recently completed survey by the Chicago Booth/Kellogg School of Business revealed “that even people morally opposed to strategic default said they would be more likely to default on their mortgage loan if they knew their lender or bank had been accused of predatory lending”.

Luigi Zingales, co-author of the study noted that “Interestingly, 48 percent of Americans said they would be more likely to default if their bank was accused of predatory lending, even if they’re morally opposed to strategic default. And, 11 percent said they’d be less likely to pay their mortgage and more likely to walk away from their loan if their bank or lender used false or faulty documentation in trying to foreclose. One likely reason for this may be related to a psychological notion of retribution – as if the homeowner is more likely to get back at their bank or lender for being dishonest in the first place.”

One factor that may impede borrowers’ desire to strategically default is that “58 percent of homeowners said they now believed lenders would pursue those who default on their mortgage, versus 53 percent in September 2010. And, the increase was more apparent in recourse states.” If the number of borrowers with significant negative equity continues to increase, many borrowers may decide to roll the dice and default anyways given the large economic incentives to do so.

Ironically, the survey also showed that consumers have become more confidence about real estate. The last survey in September 2010 showed 46% of respondents confident that prices would remain stable. The most recent survey for the quarter ended December 31st shows 54% believe prices will remain stable while only 22% believe that home prices will fall in the next 12 months.

Those respondents forecasting stable or increased home prices are likely to wind up disappointed. Major markets bottoms never occur when the majority of people are bullish. Ultimate bottoms finally arrive when the majority are extremely bearish and conclude that prices will never increase again. Extreme pessimism is the hallmark of final price capitulation and we have not yet reached that point.

It is critical that people understand the severity of the housing market. This information should be featured on CNN or headline news so that people are kept aware of the housing market troubles, and to help eliminate future problems by buyers and sellers looking to get in on the bottom, and get stuck in an economic nightmare.

Thank you, Barney Frank. We see how everything at Frannie Mac was just peachy.