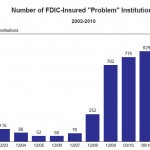

The FDIC cannot close banks fast enough. The latest Quarterly Banking Profile shows an increase in the number of problem banks to 884 at December 31, 2010 up from 860 at the end of September 2010. The number of Problem Banks now totals 12% of all FDIC insured institutions. For the quarter ending December 31, […]

Charter Oak Bank of California Becomes Nation’s 21st Banking Failure

California saw its third banking failure this year as regulators closed a small bank that had been overwhelmed by loan losses. Charter Oak Bank of Napa, California, was closed today by the California Department of Financial Institutions, which appointed the FDIC as receiver. The FDIC sold the failed bank to Bank of Marin, Novato, California, […]

San Luis Trust Bank of California Fails And Sold To Bank With Unpaid TARP Loan

San Luis Trust Bank, FSB, San Luis Obispo, California, was closed today by the Office of Thrift Supervision which appointed the FDIC as receiver. The FDIC sold the failed bank to First California Bank, Westlake Village, California. First California will assume all deposits of the failed bank. San Luis Trust was beset by a high […]

Habersham Bank Fails In Georgia

Habersham Bank of Clarkesville, Georgia, was closed today by the Georgia Department of Banking and Finance. The FDIC, as receiver, sold the failed bank to SCBT National Association, Orangeburg, South Carolina. SCBT will assume all the deposits of Habersham Bank. Habersham Bank has a very long history dating back to 1904 when the bank was […]

Canyon National Bank of Palm Springs, CA, Closed By Regulators

Canyon National Bank, Palm Springs, CA, was closed today by the Office of the Comptroller of the Currency, which appointed the FDIC as receiver. The FDIC entered into a purchase and assumption agreement with Pacific Premier Bank, Costa Mesa, CA, to assume all deposits of failed Canyon National. All three branches of Canyon will be […]

Peoples State Bank, Hamtramck, Michigan, Closed By Regulators

Peoples State Bank, Hamtramck, MI, was closed today by the Michigan Office of Financial and Insurance Regulation, which appointed the FDIC as receiver. The FDIC sold the failed bank to First Michigan Bank, Troy, Michigan, which will assume all deposits of Peoples State. The ten branches of Peoples State will reopen as usual on Saturday […]

Sunshine State Community Bank, Port Orange, Florida, Collapses

Sunshine State Community Bank, Port Orange, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the FDIC as receiver. Sunshine was a five branch bank which opened in mid 2000. During the real estate boom of the early 2000’s, the Bank rapidly expanded its assets, growing from $20 million in 2000 […]

FDIC Warns Banks On Potential Losses By Depositors

The ultimate nightmare for a bank customer is to have uninsured funds in a failed bank. Depositor losses at FDIC insured institutions occur more frequently than most people realize. Twice already in 2011, depositors at two failed banks have lost money on uninsured deposits. When a bank fails, the FDIC as receiver, will typically find […]

Failed Community First Bank of Chicago Sold To Wintrust Corp

February 4, 2011 – Community First Bank, Chicago, Illinois, was closed today by the Department of Financial and Professional Regulation, which appointed the FDIC as receiver. The FDIC sold the failed bank to Northbrook Bank and Trust Company, Northbrook, Illinois, which will assume all deposits of Community First. Community First was a small one branch […]

North Georgia Bank Fails Under Crush of Defaulting Loans

February 4, 2011 – The Georgia Department of Banking and Finance closed troubled North Georgia Bank, Watkinsville, Georgia, and appointed the FDIC as receiver. The failed bank was sold by the FDIC to BankSouth, Greensboro, Georgia, which assumed all deposits of North Georgia Bank. North Georgia Bank was put under regulatory oversight with the issuance […]