Habersham Bank of Clarkesville, Georgia, was closed today by the Georgia Department of Banking and Finance. The FDIC, as receiver, sold the failed bank to SCBT National Association, Orangeburg, South Carolina. SCBT will assume all the deposits of Habersham Bank.

Habersham Bank has a very long history dating back to 1904 when the bank was formed by three local businessmen. The Bank expanded over the years and at the time of closing had eight branch offices throughout North Georgia.

Habersham Bancorp was the holding company for Habersham Bank. The company’s stock has been on a steady slide to oblivion since 2008 when the stock was selling for $25 per share. The closing price of Habersham Bancorp today was 27 cents per share and the stock is now virtually worthless.

Depositors will have full access to their money over the weekend and all branches of Habersham will reopen as branches of SCBT.

At December 31 2010, Habersham had total assets of $387.6 million and total deposits of $339.9 million. SCBT agreed to purchase all of the assets of Habersham, subject to a loss-share transaction with the FDIC on $270.7 million of the purchased assets. The loss-share transaction protects SCBT from losses on the purchase of the failed bank’s assets. According to the FDIC, the use of loss-share agreements keeps assets in the private sector and thus minimizes losses.

This is the second failed bank acquisition for SCBT. In January, 2010, SCBT acquired failed Community Bank and Trust of Cornelia, Georgia, which had assets of $1.21 billion. SCBT Financial Corporation, the holding company for SCBT accepted $65 million in TARP funds from the US Treasury but has paid back the money in full.

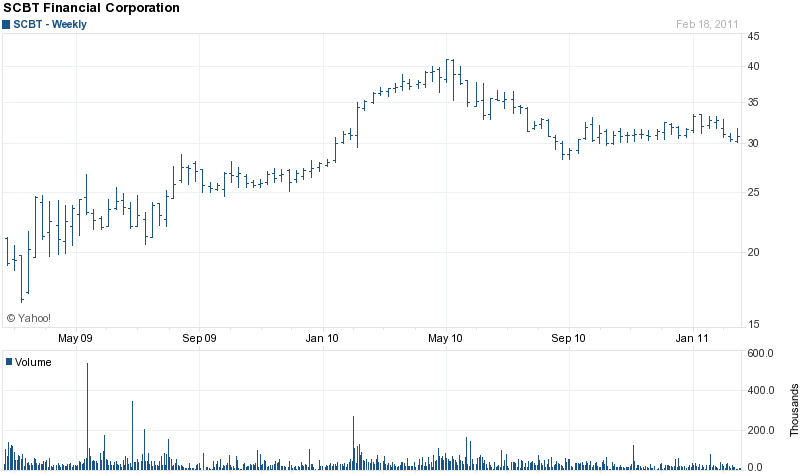

SCBT was founded in 1934 and is the fourth largest bank in South Carolina operating 50 financial centers with over $3.6 billion in assets. The Company’s stock has doubled since the lows of 2009 and it pays shareholders a 2.2% dividend.

The estimated loss for the failure of Habersham Bank to the FDIC Deposit Insurance Fund is $90.3 million or 23% of total assets. Habersham is the nation’s 19th banking failure this year and the fifth in Georgia.

Speak Your Mind

You must be logged in to post a comment.