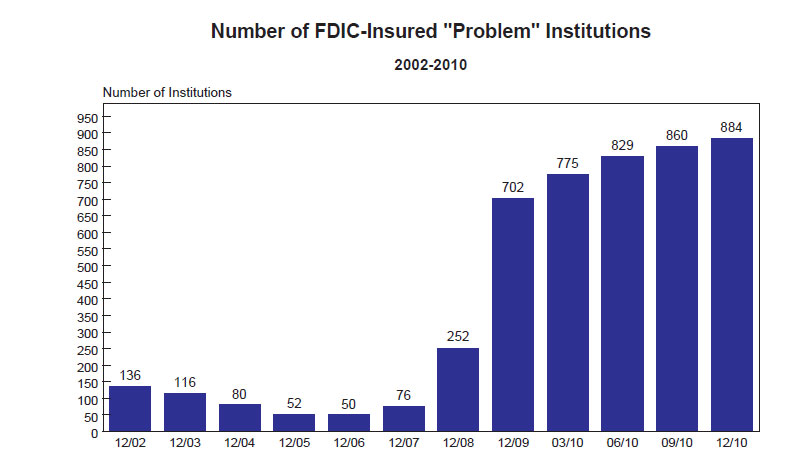

The FDIC cannot close banks fast enough. The latest Quarterly Banking Profile shows an increase in the number of problem banks to 884 at December 31, 2010 up from 860 at the end of September 2010. The number of Problem Banks now totals 12% of all FDIC insured institutions.

For the quarter ending December 31, 2010, there were a total of 30 banking failures. The probability that all of these failed banks had been classified as “problem banks” is very high, assuming that regulators are properly monitoring the financial condition of insured institutions. Considering the net reduction of the 30 problem banks that failed during the fourth quarter of 2010, there was a net addition of 54 banks added to the Problem Bank List.

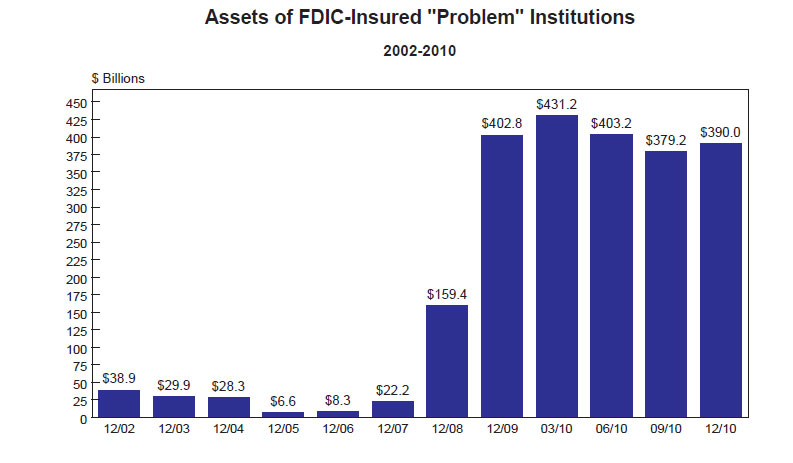

The total assets of Problem Banks increased to $390 billion from $379 in the prior quarter reflecting the increased number of banks classified as “problem banks”. The assets of problem banks has declined only slightly from $403 billion at December 31, 2009 despite the closing of 179 banks since that time. Total assets of all 179 banking failures to date from January 1, 2010 amounted to $101.43 billion. There were 157 banking failures for all of 2010 and 22 so far in 2011.

The average assets of a Problem Bank is $441.2 million, according to FDIC statistics, reflecting the difficulties that smaller institutions have had in recovering from declining real estate markets, low loan demand and high default rates. The country’s biggest banks accounted for virtually all of banking industry profits during the last quarter of 2010. Banks with assets of over $10 billion earned $20.6 billion of total industry profits of $21.7 billion, indicating that smaller bank on average, were lucky to break even. The country’s banking industry in dominated by the four largest banks – Bank of America, Wells Fargo, JP Morgan Chase and Citigroup.

Despite assurances from the FDIC that the banking industry is recovering, there are many reasons for concern (see Seven Reasons Why Banking Failures Will Increase During 2011). Residential loan delinquencies remain near record levels and 25% of all homeowners are in a negative equity situation which is a prime motivator for default. The recent surge in oil prices could tip millions more into foreclosure as surging oil and gas prices destroy family budgets.

my first observation is not that troubled assets went down because the number of troubled banks has risen. total distressed assets may have only reduced because of the banks taken out of the market in the last six months. bankalchemist.