The uproar on social media and complaints filed with regulatory agencies about the M&T/People’s merger fiasco has been so loud that the Attorney General for the State of Connecticut has become involved. People’s United customers have endured long waits at branch offices, inability to access their accounts, ridiculously long hold times when calling the bank, […]

Problems for M&T/People’s Bank Merger Escalate as Connecticut Attorney General Gets Involved

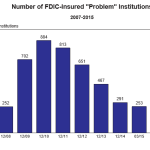

FDIC Insured Problem Banks at Lowest Level Since 2008

The number of banks on the FDIC Problem Bank List continues its steady decline since peaking at 888 banks in March 2011. According to the latest FDIC Quarterly Banking Profile the number of problem banks stood at 203 as of September 30, 2015, down by 25 banks since the previous quarter. The number of problem […]

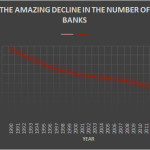

The Amazing Decline in the Number of Banks Has Resulted in Big Bank Domination

The number of banks operating in the United States has been in an amazing decline for the past 25 years. Many institutions disappeared after going bust during the savings and loan crisis of the early 1990’s while hundreds more collapsed during the financial panic and banking crisis that started in 2008. Since 2008 a total […]

Problem Banks Fall to Six Year Low

According to the latest FDIC Quarterly Banking Profile the number of problem banks has declined to a six year low. As of March 31, 2015, a total of 253 banks were still classified as problem banks by the FDIC, down from 291 at the end of 2014. During the first quarter of 2015 a total […]

Edgebrook Bank, IL, Closed by Regulators – Fifth Bank Failure of 2015

After over a two month hiatus with no bank closings, regulators swooped in to close the Edgebrook Bank, Chicago, Illinois. The last banking failure occurred on February 28, 2015 when regulators closed the Doral Bank, San Juan, Puerto Rico. After the Illinois Department of Financial & Professional Regulation closed Edgebrook Bank, the FDIC was appointed […]

Bank Failures Decline But Still Above Pre Banking Crisis Levels

Prior to the banking crisis that began in 2008 bank failures had been a rare occurrence with only 32 banking failures between 2000 to 2007. During 2008 the wheels began to fall off the financial system and bank failures increased dramatically as loan defaults soared. As the banking crisis worsened bank failures reached a peak […]

Doral Bank Collapses After Years of Financial Losses – Largest Bank Failure Since 2010

The largest bank failure since 2010 left the FDIC on the hook for almost $1 billion in losses as the giant $5.9 billion asset Doral Bank, San Juan, Puerto Rico, was closed by bank regulators. Doral Bank has been a bank failure waiting to happen as years of losses and economic turmoil in Puerto Rico […]

Number of Problem Banks Declines for 15th Consecutive Quarter

According to the latest FDIC Quarterly Banking Profile the number of problem banks continued to decline for the quarter ending December 31, 2014. After reaching a peak of 888 at the end of the first quarter of 2011 the number of problem banks has declined for 15 consecutive quarters. The number of problem banks is […]

Capitol City Bank & Trust Co, Georgia, Collapses – Largest Bank Failure of 2015

The largest bank failure of the year occurred today as regulators closed down Capitol City Bank & Trust Company, Atlanta, Georgia. After shuttering the bank, the Georgia Department of Banking & Finance appointed the FDIC as receiver. To protect depositors the FDIC sold the failed bank under a purchase and assumption agreement to First-Citizens Bank […]

Banking Industry Profits and Revenues Show Strong Increase in 2014 Third Quarter

The latest FDIC Quarterly Banking Profile for the quarter ending September 30, 2014 shows a strong increase in both profits and revenues as the recovery in the banking industry continues. Banking industry profits rose to $38.7 billion during the third quarter, up by $2.6 billion or 7.3 percent from $36.1 billion in the comparable prior […]