After over a two month hiatus with no bank closings, regulators swooped in to close the Edgebrook Bank, Chicago, Illinois. The last banking failure occurred on February 28, 2015 when regulators closed the Doral Bank, San Juan, Puerto Rico. After the Illinois Department of Financial & Professional Regulation closed Edgebrook Bank, the FDIC was appointed […]

Edgebrook Bank, IL, Closed by Regulators – Fifth Bank Failure of 2015

Four Banks Fail – FDIC Losses Approach $1 Billion On YTD Bank Closings

Regulators closed four banks in Tennessee, Minnesota and Florida, bringing the total for the year to seven. Tennessee, with two bank closings, had previously not had a single bank failure since 2002. The combined assets of the two failed banks in Tennessee totaled $1.5 billion. Tennessee Commerce Bank of Franklin, TN, became the first billion […]

List Of 2011 Bank Failures Reveals Interesting Facts

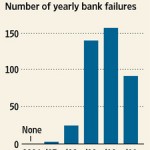

A total of 92 banks failed during 2011, signaling a continuation of the crisis in the banking industry. Although total banking failures during 2011 declined from the previous year, the number remains historically high. The last time more than 50 banks failed in one year was 1992 or 20 years ago. The complete list of […]

Four Banks Closed In Georgia, Florida and Colorado – Losses Now Total $7 Billion

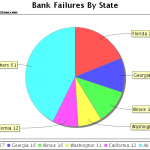

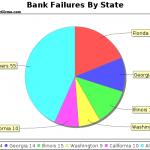

The continued decline in real estate values and aggressive lending during the real estate boom continue to haunt the banking industry. Regulators closed four banks in three states this week bringing the total banking failures for the year to 84. Two banks were closed in Georgia which now accounts for 26% of all U.S. banking […]

Four Bank Failures In Four States Brings Year’s Total To 80

Regulators across the nation had a busy Friday evening, closing four banks in four different states. This week’s banking failures increase the total number of failed banks for 2011 to 80. During 2010, regulators closed a total of 157 banks across the nation. The FDIC is optimistically predicting a much lower number of banking failures […]

2010 Banking Failures By State – Why 2011 Should Look The Same

The most severe financial crisis since the 1930’s resulted in a nationwide drop in real estate values and the largest number of banking failures since 1992. The huge buildup of debt that fueled the bubble in real estate prices has resulted in a record number of mortgage defaults and foreclosures. During 2010, a total of […]

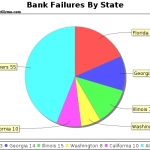

Florida Leads The Nation In Banking Failures – 5 States Account For Almost 60% Of Total Banking Failures

November 5, 2010 – A nationwide drop in real estate values combined with an all time high in mortgage defaults and foreclosures have resulted in banking failures across 28 States. As of November 5, there were a total of 143 banking failures in the US and Puerto Rico. The five States with the greatest number […]

Shoreline Bank, Shoreline, Washington, Closed By Regulators

October 1, 2010 – Shoreline Bank, Shoreline, Washington, was closed today by the Washington Department of Financial Institutions, which appointed the FDIC as receiver. The FDIC entered into a purchase and assumption agreement with GBC International Bank, Los Angeles, California, to assume all deposits and a portion of failed Shoreline’s assets. According to GBC’s website, […]

Banking Failures In Washington and Florida Bring Year’s Total To 127

September 24, 2010 – Banking failures in Washington and Florida brought the nation’s total number of banking failures to 127. The State of Florida remains unchallenged as the nation’s top state for banking failures. With this week’s failure of Haven Trust Bank Florida, Florida now accounts for nearly 20% of the total banking failures for […]

Banking Failures Spread To 28 States Across The Nation

A nationwide drop in real estate values combined with an all time high in mortgage defaults and foreclosures have resulted in banking failures across 28 States. As of September 17, there were a total of 125 banking failures in the US and Puerto Rico. The five States with the greatest number of banking failures are […]