Heritage Banking Group, Carthage, MS, was closed today by the Mississippi Department of Banking and Consumer Finance. The FDIC was named as receiver and sold the bank to Trustmark National Bank, Jackson, MS, which will assume all deposits of Heritage Banking. Heritage Banking had 8 branches which will reopen on Monday as branches of Trustmark. […]

Superior Bank of Alabama Becomes First Billion Dollar Bank Failure of 2011

Superior Bank of Birmingham, Alabama, was closed today by the Office of Thrift Supervision, which appointed the FDIC as receiver. To protect depositors, the FDIC sold Superior Bank to Superior Bank, N.A., a newly chartered bank subsidiary of Community Bancorp of Houston, Texas. Superior Bank, N.A. will assume all deposits and purchase all assets of […]

Nexity Bank, Birmingham, Alabama, Closed By Regulators

Shareholders of Nexity Financial Corp, the holding company for Nexity Bank, saw all hope for a recovery in their investment evaporate today as regulators closed Nexity Bank. Nexity Bank was closed by the State of Alabama Banking Department which appointed the FDIC as receiver. To protect depositors, the FDIC sold Nexity Bank to Alostar Bank […]

Western Springs National Bank and Trust Closed By OCC

Ninety five year old Western Springs National Bank and Trust, which survived the depression and two previous banking crises, saw its long history come to an end today when the Office of the Comptroller of the Currency closed the bank to protect depositors. The FDIC, acting as receiver, sold the bank to Heartland Bank and […]

2010 Banking Failures By State – Why 2011 Should Look The Same

The most severe financial crisis since the 1930’s resulted in a nationwide drop in real estate values and the largest number of banking failures since 1992. The huge buildup of debt that fueled the bubble in real estate prices has resulted in a record number of mortgage defaults and foreclosures. During 2010, a total of […]

The Bank of Commerce, Wood Dale, IL, Becomes 26th Banking Failure of 2011

The Bank of Commerce, Wood Dale, Illinois was closed today by the Illinois Department of Financial & Professional Regulation, which appointed the FDIC as receiver. The FDIC sold the failed bank to Advantage National Bank Group, Elk Grove Village, Illinois, which will assume all deposits and purchase all assets of The Bank of Commerce. The […]

The Reason Behind the Failure of “Well Capitalized” The First National Bank of Davis, OK

The closing of The First National Bank of Davis, Davis, Oklahoma, leaves depositors and local residents with many unanswered questions. The First National Bank of Davis has had a community presence for more than 100 years, having been established in 1895. The First National Bank maintained its sole branch in Davis and had $90.2 million […]

The FDIC Has A Problem With Bank Of America’s Proposed Dividend Increase

Speaking at Bank of America’s first investor conference since 2007, Chief Executive Brian Moynihan told shareholders that he was focused on increasing shareholder returns through share buybacks, special cash dividends and increased regular dividends. Mr. Moynihan also cheered investors on by predicting that Bank of America could earn, under normal business conditions, up to $40 […]

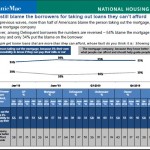

Who Is To Blame For Borrowers Taking Loans They Can’t Afford?

Ever since the mortgage crisis started in 2008, there has been a wide divergence in opinions on who was to blame for borrower defaults. Many blame greedy bankers who abdicated sound underwriting principles for financial gain by approving mortgages for unqualified borrowers. Others blame the borrowers themselves for being irresponsible and taking on debt that […]