Superior Bank of Birmingham, Alabama, was closed today by the Office of Thrift Supervision, which appointed the FDIC as receiver. To protect depositors, the FDIC sold Superior Bank to Superior Bank, N.A., a newly chartered bank subsidiary of Community Bancorp of Houston, Texas. Superior Bank, N.A. will assume all deposits and purchase all assets of failed Superior Bank.

Superior Bank become the first multi billion dollar banking failure of 2011. Superior Bank had a loss of $44 million in its last quarter and the Bank’s capital ratios declined to dangerously low levels. Superior Bank’s Teir 1 leverage ratio was only 1.4% compared to the 5% necessary to be classed as adequately capitalized. In addition, the bank’s troubled asset ratio was very high at 350% and most banks fail when this ratio reaches 100%. Over 11% of Superior Bank’s assets were classified as nonperforming assets.

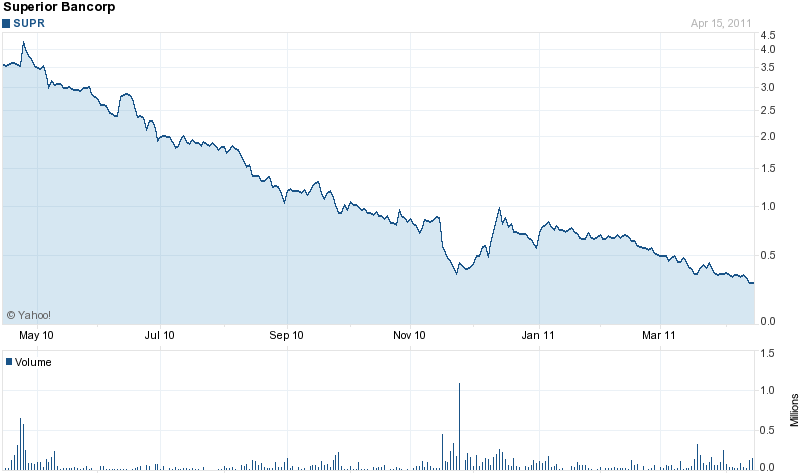

Shareholders of Superior Bancorp have seen the price of their investment drop from $45 dollars per share in 2007 to 28 cents on today’s closing price, resulting in a total loss of almost $600 million. Executives of Superior Bancorp, however, continued to draw very impressive paychecks despite the horrendous performance of Superior Bancorp. According to yahoo finance, Marvin Scott, CEO, was making $409,000 per year, Rick Gardner, President, was making $350,000 and James White, CFO, took home $309,000 per year. It was unclear if the purchasers of the failed bank will retain the services of the top executives of Superior Bank.

Superior Bank, at December 31, 2010, had total assets of $3.0 billion and total deposits of $2.7 billion.

Superior Bank N.A. will purchase all failed assets of Superior Bank subject to a loss-share transaction with the FDIC on $1.84 billion of the purchased asset pool. The loss-share transaction will limit future losses to Superior Bank, N.A. According to the FDIC, loss-share transactions result in the smaller losses by keeping failed banking assets in the private sector.

Community Bancorp (CB), which owns Superior Bank, N.A. was founded in 2009 as a bank holding company for the purpose of acquiring banks. CB was funded with private equity capital from public and private pension funds. In March CB purchased Cadence Financial Corp, a $1.8 billion asset bank with offices in five Southern states.

Superior Bank becomes the nation’s 32nd banking failure of 2011 and the second in Alabama. The loss to the FDIC on the failure of Superior Bank is estimated at $259.6 million.

Speak Your Mind

You must be logged in to post a comment.