Heritage Banking Group, Carthage, MS, was closed today by the Mississippi Department of Banking and Consumer Finance. The FDIC was named as receiver and sold the bank to Trustmark National Bank, Jackson, MS, which will assume all deposits of Heritage Banking.

Heritage Banking had 8 branches which will reopen on Monday as branches of Trustmark. Depositors will have full access to their money over the weekend.

Heritage was originally founded in 1920 as The Carthage Bank and changed its name in 2004 to Heritage Banking Group. At December 31, 2010, Heritage had total assets of $224.0 million and total deposits of $196.2 million. Trustmark will pay the FDIC a .15% premium on the assumption of Heritage’s deposits.

Trustmark also agreed to purchase all of the assets of Heritage subject to a loss-share transaction with the FDIC that limits potential losses by Trustmark on the asset pool purchased from Heritage. The loss-share transaction will cover $156.4 million of the purchased assets. By keeping failed banking assets in the private sector, the FDIC maintains that losses are minimized.

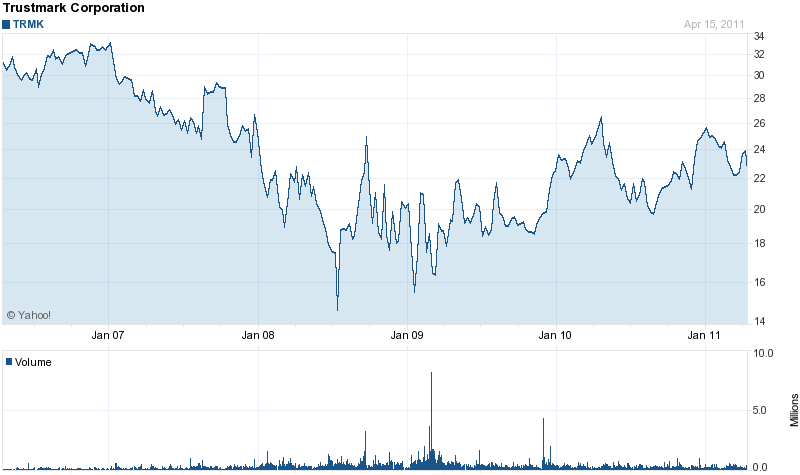

Trustmark National is a profitable and well capitalized bank with $9.5 billion in assets. The holding company for Trustmark National is Trustmark Corporation. Trustmark Corporation is a publicly trading company and has seen a major recovery in its stock price since the depths of the banking crisis in early 2009.

The failure of Heritage Banking will result in a loss to the FDIC insurance fund of $49.1 million. Heritage is the nation’s 34th banking failure of 2011 and the first in Mississippi.

Speak Your Mind

You must be logged in to post a comment.