After a hiatus of almost two months bank failures resumed with a Florida bank becoming the 17 bank failure of the year. Regulators got back to work and closed the First Community Bank of Southwest Florida, Fort Meyers, FL, also operating as Community Bank of Cape Coral, Cape Coral, FL. The holding company for the […]

Feds Close First Community Bank of Southwest Florida – 17th Bank Failure of 2013

Mountain National Bank, Tennessee, Closed By Regulators – 16th Bank Failure of 2013

Mountain National Bank, Sevierville, TN was closed today by the Office of the Comptroller of the Currency. The FDIC, appointed as receiver, sold the failed bank to First Tennessee Bank, N.A., Memphis, TN, which will assume all deposits of Mountain National Bank. Originally founded in 1998, Mountain National Bank becomes the first bank failure of […]

1st Commerce Bank, Nevada, Closed By Regulators – Fourth Bank Collapse In A Month for Capitol Bancorp

Nevada had its first bank failure in over two years as regulators swooped in to close tiny 1st Commerce Bank, North Las Vegas, Nevada. After closing the bank, the FDIC exercised its powers as receiver and sold the failed bank to Plaza Bank, Irvine, CA. All customer of 1st Commerce will automatically become customers of […]

Banks of Wisconsin, Closed By Regulators, Becomes 14th Bank Failure of 2013

Wisconsin had its first bank failure in over two years on Friday when state regulators closed Banks of Wisconsin, Kenosha, Wisconsin. The FDIC, appointed as receiver, sold the failed bank to North Shore Bank, FSB, Brookfield, Wisconsin, which will assume all deposits of Banks of Wisconsin. Banks of Wisconsin, established in June 2000, had two […]

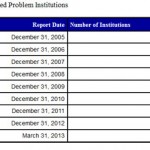

FDIC Problem Bank List Includes Almost 9% of All Banks

The number of problem banks declined slightly during the first quarter of 2013. According to the latest Quarterly Banking Profile released today by the FDIC, the number of problem banks declined from 651 to 612, for a net reduction of 39 banks. Although profits for the overall banking industry have increased for the past 15 […]

Central Arizona Bank Fails – Third Bank Failure In A Week For Capitol Bancorp, Ltd

In an unusual weekday action, state regulators closed Central Arizona Bank, Scottsdale, AZ, and appointed the FDIC as receiver. To protect depositors, the FDIC sold the failed bank to Western State Bank, Devils Lake, North Dakota, which will assume all deposits of Central Arizona Bank. With only $31.6 million in assets, the failure of Central […]

Sunrise Bank, GA, Closed As Regulators Zero In On Capitol Bancorp

Regulators closed the second bank of the day controlled by Capitol Bancorp, the troubled holding company that holds 11 different banks in nine different states. Sunrise Bank, Valdosta, GA, was closed by state regulators while earlier in the day, regulators closed Pisgah Community Bank, N.C., also owned by Capitol Bancorp. The FDIC, acting as receiver, […]

Douglas County Bank, GA, Biggest Bank Failure of 2013

Douglas County Bank, Douglasville, GA, was closed today by the Georgia Banking Department. The FDIC, acting as receiver, sold Douglas County Bank to Hamilton State Bank, Hoschton, Georgia, which will assume all deposits of the failed bank. Regulators have been closing a series of small sized banks this year that were unable to recover financially […]

Parkway Bank, NC, Closed By Regulators

Parkway Bank, a North Carolina chartered bank headquartered in Lenoir, NC, was closed today by state regulators. Acting as receiver, the FDIC entered into a purchase and assumption agreement with CertusBank, N.A., Easley, South Carolina, which will assume all deposits of Parkway Bank. Founded in 2001, Parkway Bank has been a problem bank for regulators […]

Chipola Community Bank, FL, Closed By Regulators

After going without a banking failure since November 2012, regulators closed two Florida banks on Friday. Shortly after closing the Heritage Bank of North Florida, regulators closed Chipola Community Bank of Marianna, Florida. During 2012 a total of eight banks failed in Florida, accounting for 16% of the 51 bank failures nationwide. Chipola Community Bank […]