July 16, 2010 – First National Bank of the South was closed by the Office of the Comptroller of the Currency, which appointed the FDIC as receiver. The FDIC entered into a purchase and assumption agreement with NAFH National Bank, Miami, Florida (a newly-chartered bank subsidiary of North American Financial Holdings, Inc., Charlotte, North Carolina) […]

First National Bank of the South, South Carolina, Closed By Regulators

Ideal Federal Savings Bank, Baltimore, MD, Closed By Regulators

July 9, 2010- Ideal Federal Savings Bank, Baltimore, Maryland, was closed today by the Office of Thrift Supervision, which appointed the FDIC as receiver. The FDIC, as receiver, could not find a buyer for this tiny one branch bank with only $6.3 million in assets and $5.8 million in deposits. Accordingly, the FDIC will payoff […]

Fannie Mae Seeks To Limit Mortgage Losses On “Strategic Defaults”

June 23, 2010 – Borrowers who chose to default on mortgages that they are capable of paying will be facing a long wait before they are able to own a home again under new Fannie Mae guidelines. The new rules come at a time when considerable attention is being focused on “strategic defaults” in which […]

FDIC Chairman’s Explanation For Housing Bubble And Bust Leaves Big Question Unanswered

Housing Bubble and Crash Explained – The Common Sense Explanation Thousands of articles have been written explaining how the bubble in housing developed and why it subsequently came crashing down, causing the collapse of some of the biggest financial institutions in the United States. Perhaps most of us are simply worn down or confused by […]

First National Bank, Rosedale, MS Fails – First Banking Failure In Ten Years For Mississippi

Mississippi Sees First Banking Failure In 2010 The Office of the Comptroller of the Currency closed First National Bank, Rosedale, MS, and appointed the FDIC as receiver. The Jefferson Bank, Fayette, MS took over First National and agreed to assume all deposits and purchase essentially all of the assets of the failed bank. First National, […]

Regulators Cannot Stop Foolish Lending Decisions

Banking Links – February 19, 2010 Frightened Banks Hoard Cash – The Economist Second Mortgage Writedowns Next Big Problem For Banks – NMN “Council of Regulators” To Protect Against Systemic Financial Risks – Yahoo News Debts That Cannot Be Repaid Will Not Be Repaid – Munis At Risk – WSJ Fed Hikes Discount Rate – […]

Banking News

To Rein In Pay Rein In Wallstreet Why are financial industry paychecks so big? Those who want to do something about bringing that pay down ought to focus on why there has been so much money in the financial sector in recent years. It should be no surprise that people in that business wanted to […]

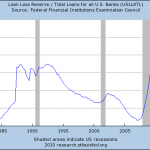

Regulators Admit To Huge Decline In Loan Credit Quality

No End In Sight To Debt Defaults The extent of the continued severe deterioration in loan credit quality was revealed in the Shared National Credits Review, issued jointly by the Federal Reserve, FDIC, Office of the Comptroller of the Currency and the Office of Thrift Supervision. Credit quality declined sharply The credit risk of these […]

FDIC Loan Guarantees Under TLGP Decline Again For August 2009

FDIC Debt Guarantees Decline 4% In August The FDIC Temporary Loan Guarantee Program (TLGP) was instituted late last year. The program’s stated purpose and goals, according to the FDIC, is as follows: The FDIC has created this program to strengthen confidence and encourage liquidity in the banking system by guaranteeing newly issued senior unsecured debt […]

One Failed Bank For September 25, 2009

Banking Failures – 95 And Counting 2009 has now seen a total of 70 more failed banks than occurred for all of 2008. The latest banking closure brings total banking failures for 2009 to 95. The latest failed bank on September 25, 2009 had total assets of $2 billion and total losses to the FDIC […]