June 23, 2010 – Borrowers who chose to default on mortgages that they are capable of paying will be facing a long wait before they are able to own a home again under new Fannie Mae guidelines. The new rules come at a time when considerable attention is being focused on “strategic defaults” in which a borrower determines that it is no longer in his financial interest to continue making payments despite being financially able to do so.

With nearly 25% of homeowners owing more on their homes than they are worth, Fannie Mae is implementing the new guidelines in an attempt to prevent a new wave of foreclosures that would lead to further deterioration of home prices and additional mortgage defaults.

Fannie Mae’s announcement will impose a seven year waiting period on borrowers before being eligible for a new mortgage unless the default was the result of extenuating circumstances.

A variety of foreclosure alternatives are available to borrowers who are having difficulty making their mortgage payments.

Currently, the waiting period that must elapse after a borrower experiences a foreclosure is seven years. However, Fannie Mae allows a shorter time period – five years – if certain additional requirements are met. These requirements are being modified to remove the five year option. Unless the foreclosure was the result of documented extenuating circumstances, which only requires a three-year waiting period (with additional requirements), all borrowers will now be required to meet a seven-year waiting period after a prior foreclosure to be eligible for a new mortgage loan eligible for sale to Fannie Mae.

In addition, Fannie Mae will seek deficiency judgments when legally allowed, as compensation for losses on defaulted mortgages. Fannie’s Executive Vice President, Terence Edwards, noted that “Walking away from a mortgage is bad for borrowers and bad for communities, and our approach is meant to deter the disturbing trend towards strategic defaulting”.

With defaults and foreclosures reaching epidemic levels, Fannie’s actions are an attempt to keep mortgage defaults from spiraling out of control. It remains to be seen what impact Fannie’s actions will have in slowing the mortgage default tidal wave.

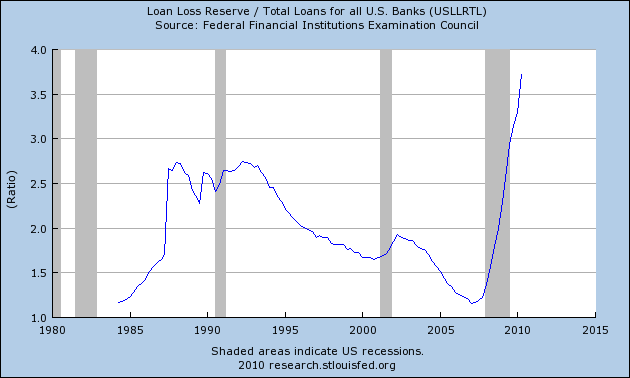

Loan Loss Reserves Hit All Time High

Speak Your Mind

You must be logged in to post a comment.