October 6, 2010 – It has been almost two years since the banking system nearly imploded in 2009, requiring a massive government bailout. The biggest banks in the country have now repaid government bailout funds and raised billions of dollars to strengthen capital ratios. The stock prices of Bank of America, Wells Fargo and Citigroup […]

Majority Of Americans Lack Confidence In Stability of US Banking System

FDIC Issues Consent Orders & Prompt Corrective Actions To 26 Banks

October 1, 2010 – The FDIC recently released a list of orders of administrative enforcement actions taken against banks, including 22 “Consent Orders” (formerly called “cease and desist consent orders”) and 4 Prompt Corrective Actions. A cease and desist order (consent order) is issued when the FDIC has “determined that it had reason to believe […]

North County Bank, Arlington, Washington, Failed Bank #127

September 24, 2010 – North County Bank, Arlington, Washington, a four branch bank founded in 2001, was closed today by the Washington Department of Financial Institutions, which appointed the FDIC as receiver. The FDIC entered into a purchase and assumption agreement with Whidbey Island Bank, Coupeville, Washington, to assume all deposits and purchase all assets […]

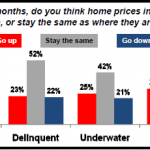

Fannie Mae Housing Survey – Consumers Believe Prices Have Bottomed But Prefer To Rent

The large and continuing decline in asset values has been one of the greatest contributing factors to loan defaults and subsequent banking failures. Today’ release of Fannie Mae’s National Housing Survey provides good news for banks if consumers are correct in their belief that housing prices have bottomed. The survey reveals that 78% of Americans […]

Identity Thieves Impersonate FDIC To Steal Money

September 9, 2010 – As if the Federal Deposit Insurance Corporation (FDIC) didn’t have enough issues to contend with, it now appears than criminals are impersonating the FDIC in an attempt to steal money or obtain sensitive financial information from consumers. The FDIC reports that it has received numerous reports of scam artists calling consumers and […]

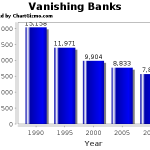

Vanishing Banks – U.S. Loses 7,300 Banks Since 1990

September 4, 2010 – The latest FDIC Quarterly Banking Profile reports that for the first time in almost ten years, the number of banks has declined by more than 100 in a single quarter. The number of banking institutions declined by 104 for the quarter ending June 30, the most since 113 in the third […]

Imperial Savings and Loan, Martinsville, Virginia, Closed By Regulators

August 20, 2010 -Imperial Savings and Loan Association, Martinsville, Virginia, was closed today by the Office of Thrift Supervision, which appointed the FDIC as receiver. Imperial Savings was purchased by another local bank, River Community Bank, N.A., Martinsville, Virginia, which will assume all deposits and purchase essentially all assets of the failed bank. Imperial Savings, […]

Mortgage Jobs Disappear As Rates Hit All Time Lows

In what can only be described as cruel irony, the number of jobs in the mortgage industry continue to disappear as rates hit all time lows. Traditionally, all time lows in mortgage rates have resulted in a refinance boom, increased hiring by mortgage companies and hefty paychecks for mortgage loan originators. This time, things are […]

Williamsburg First National Bank Of South Carolina Closed By OCC

July 23, 2010 – Williamsburg First National Bank – Banking Failure #99 See analysis of this week’s bank closings at – Banking Failures Hit 103 As Regulators Close Seven More Banks FDIC – Williamsburg First National Bank, Kingstree, South Carolina, was closed today by the Office of the Comptroller of the Currency, which appointed the […]