September 4, 2010 – The latest FDIC Quarterly Banking Profile reports that for the first time in almost ten years, the number of banks has declined by more than 100 in a single quarter.

The number of banking institutions declined by 104 for the quarter ending June 30, the most since 113 in the third quarter of 2000. Banking failures accounted for the loss of 45 banks with the remaining due to mergers with other banks. With numerous banks reporting losses due to the financial crisis and weak economy, it is no surprise that the number of banks are dwindling.

Prior to the banking crisis, the number of new banking charters routinely averaged 100 – 200 per year. For the quarter ending June 30, for the first time in 38 years for which data is available, no new banks were started.

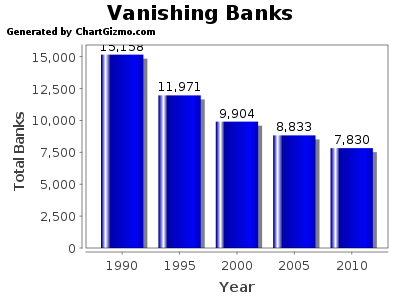

The reduction in the number of banks continues a long term trend. The US banking industry has been shrinking dramatically for the past 20 years. Since 1990, the US has lost a total of 7,328 banks – a reduction of 46%. In 1990 the US had a total of 15,158 commercial banks and savings institutions. At June 30, the number of banking institutions had declined to 7,830.

Despite two major banking crises in the past two decades the vast majority of banks have not disappeared through failures but rather by mergers. Of the 7,328 banks that have disappeared since 1990, banking failures accounted for only 1,202 (16.4%) of the vanished banks.

The majority of assets in the banking industry are now concentrated in the largest institutions. The most recent numbers reported show that the there are 105 banking institutions with assets of $10 billion or greater. These 105 institutions, representing only 1.3% of the banks in the US control a staggering 78.4% of total banking assets, representing $10.4 trillion dollars. The remaining 7,725 banks have only 21.6% of total banking industry assets.

Speak Your Mind

You must be logged in to post a comment.