October 6, 2010 – It has been almost two years since the banking system nearly imploded in 2009, requiring a massive government bailout. The biggest banks in the country have now repaid government bailout funds and raised billions of dollars to strengthen capital ratios. The stock prices of Bank of America, Wells Fargo and Citigroup now trade at prices three to four times higher than the lows of early 2009.

The apparent recovery in the banking industry, however, has done little to increase public confidence. As foreclosures, defaults, banking failures and unemployment continue at record levels, the American public senses that the financial system still remains extraordinarily fragile (see IMF Says Risk To Banking System Remains Elevated).

The lack of confidence by the US public in the banking system is merited based on the trends of debt and income. Debt levels have exploded exponentially while incomes have remained stagnant. Debts that cannot be adequately serviced by income streams will eventually default, resulting in additional losses for a banking system still struggling to recover.

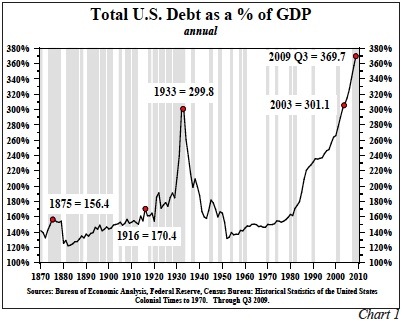

Total US indebtedness has increased at a staggering pace over the past decades and exceeds any prior historical precedence.

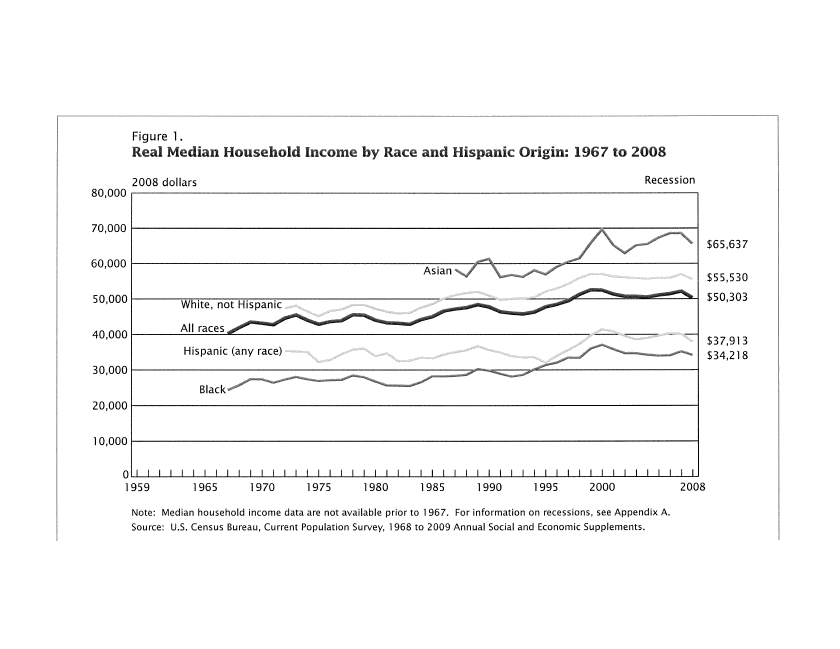

Incomes have dramatically lagged the increase in debt, resulting in massive defaults. The average median household income has not increased over the past decade. An unemployment rate that remains at double digits compounds the difficulty of servicing debt on both the individual and governmental level.

Confidence by depositors is an essential requirement for a properly functioning banking system. Unfortunately, a recent poll by Rasmussen Reports indicates a great sense of unease regarding the stability of the US banking system. According to Rasmussen, “only 8% are very confident in the stability of America’s banks, while 11% are not at all confident”. In addition, the survey shows that “54% lack confidence in the stability of the US banking industry”. Prior to the financial crisis, 68% of the public had confidence in the banking system.

Rasmussen’s survey also showed that 32% of Americans are “at least somewhat worried” and 8% are “very worried” about the money they have on deposit in the bank. Most of the American public still professes to be unconcerned about losing money in a banking failure, despite the admission by government officials that the entire financial system was on the precipice of collapse in 2008.

On a positive note, the financial system has survived to date and, over time, may regain stability and strength if the economy recovers. Meanwhile, if you are very worried about keeping your money in the bank, what viable alternative options exist?

Speak Your Mind

You must be logged in to post a comment.