The FDIC today released an update on expected losses for banking failures through 2015.

For the five year period 2011 through 2015 the FDIC is forecasting total losses from banking failures of $19 billion. Total losses from banking failures during 2010 were $23 billion compared to $6.4 billion in 2011 year to date losses. A total of 157 banks failed in 2010 compared to year to date failures of 76 banks in 2011.

Subtracting current year banking losses from the FDIC five year projection implies that the FDIC is expecting total additional losses from failed banks of $12.6 billion through the end of 2015. This amounts to only about $3 billion in banking losses per year for the next four years.

The FDIC admits that its loss projections for failed banks “are subject to considerable uncertainty”. FDIC Acting Chairman Martin Gruenberg said “As we seek to stay on track, it’s important to always be mindful of the challenges we face and ongoing risks to the insurance fund.”

The FDIC Chairman did not reveal the underlying assumptions for loss projections on future banking failures but the FDIC loss estimates seem wildly optimistic. Consider some of the profoundly negative macro economic issues banks currently face:

- Continued erosion in real estate values

- The inability of small banks to raise additional capital

- Low loan demand

- Decline in consumer income

- Economic indicators pointing to an economic slowdown or outright recession

- The ongoing collapse of major European banks

- Unemployment levels of almost 10%

- 11 million homeowners with mortgages that exceed the value of their home

In contrast to the rosy FDIC forecast, central bankers meeting in August at Jackson Hole, Wyoming, were gloomy and acknowledged the precarious state of the world banking system. Managing Director Christine Lagarde of the International Monetary Fund said “We risk seeing the fragile recovery derailed. We are in a dangerous new phase.”

Jean-Claude Trichet, the President of the European Central Bank, today used unusually blunt language while warning about the global financial crisis. Mr. Trichet said “We are at the epicenter of a global crisis”, and the banking and sovereign debt problems in the Euro zone have “reached a systemic dimension.”

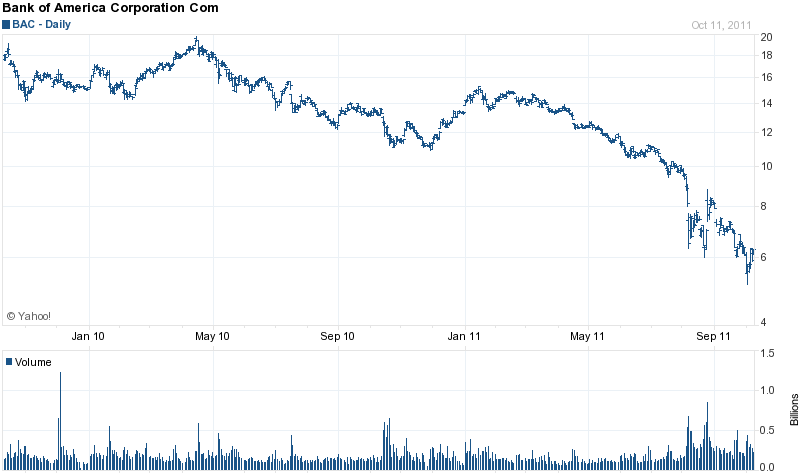

Major European banks are failing, including giant Dexia, which collapsed over the weekend. The world banking system is intricately interconnected and a systemic banking crisis in Europe would quickly spread to the United States. Confidence in the largest U.S. banks has already collapsed as evidenced by the massive drop in the value of bank stock shares (see Bank of America chart below).

Another major problem facing the FDIC which could drive failed bank losses higher is the large number of Problem Banks. At June 30, 2011, the FDIC had 865 banks on its Problem Bank List, representing almost 12% of all FDIC insured institutions.

The Problem Banks have total assets of $372 billion. The banks that failed in 2011 cost the FDIC losses averaging 20% of total assets. If only three quarters of the Problem Banks fail, the estimated loss to the FDIC (based on 20% of total assets) would be $55.8 billion, far in excess of FDIC loss estimates of $12.6 billion.

The FDIC also released today updated reserve projections for the Deposit Insurance Fund (DIF) which protects insured depositors from losses in the event of banking failures. The FDIC projects that the Deposit Insurance Fund (DIF) will reach a reserve ratio of 1.15% by 2018.

The FDIC DIF currently has a reserve ratio of only 0.06%, which means the FDIC is protecting every $10,000 in depositor funds with only $6. The Dodd-Frank Act requires the FDIC DIF to reach a reserve ratio of 1.35%, but not until 2020. As of June 30, 2011, the DIF had a balance of only $3.9 billion which provides loss protection on $6.54 trillion of insured deposits.

Ultimately, the FDIC guarantee to protect bank depositors is based upon public confidence in a sound banking system. Ominously, public confidence has declined dramatically since the financial crisis began in 2008, with little evidence of an imminent recovery.

Hi I was looking at the FDICs website and saw the 3.9 billion in cash fund balance after assets/liabilities were factored in. The website though states as of June 30 for all FDIC domestic deposits at 8.226 trillion for all institutions. Where did the 6.54 number come from ?

Good question. You can find the amount of insured deposits on the FDIC “Statistics At A Glance” which shows insured deposits of $6.539 trillion at June 30, 2011. Not all deposits are FDIC insured.

The FDIC’s reserve ratio has been negative in the past. Does this mean they do not have te funds to cover deposits ? I’m confused about how the FDIC could have continued its role with negative reserve ratio ? Thanks.

In June 2007 the FDIC Deposit Insurance Fund balance was $52.4 billion which protected insured deposits of $4.3 trillion. Move forward to June 2011 and the Insurance Fund balance is only $3.9 billion which insures deposits of $6.5 trillion. The reserve ratio is only .06% now compared to 1.22% in June 2007. The deposit insurance fund never anticipated a major banking crisis and had to assess banks for an additional $45 billion in advance deposit insurance premiums to replenish the fund as well as raise the premium rates, so they squeaked by. Bottom line, if another major financial crisis occurs, the FDIC has very little to back up the huge amount of deposits they insure. The FDIC does have up to a $500 billion line of credit with the U.S. Treasury to address “systemic risks” but as shown by the recent credit downgrade, the borrowing ability and credit worthiness of the U.S. government is beginning to be questioned.