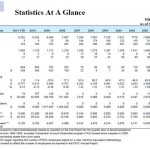

The $700 billion Troubled Asset Relief Program (TARP) that was authorized in 2008 to bailout failing financial institutions is still in the process of being wound down. The latest report from the Government Accounting Office (GAO) (which is required by law to report on TARP every 60 days) reveals that the U.S. Treasury is still […]

TARP Lives On – 370 Problem Banks Remain On U.S. Treasury Life Support

Four Banks Fail – FDIC Losses Approach $1 Billion On YTD Bank Closings

Regulators closed four banks in Tennessee, Minnesota and Florida, bringing the total for the year to seven. Tennessee, with two bank closings, had previously not had a single bank failure since 2002. The combined assets of the two failed banks in Tennessee totaled $1.5 billion. Tennessee Commerce Bank of Franklin, TN, became the first billion […]

BankEast, Knoxville, TN, Closed By Regulators

Until today, the State of Tennessee, had seemed isolated from the banking crisis. For almost a decade, there were no banking failures in Tennessee, with the last one occurring on November 8, 2002. Tennessee’s luck came to an abrupt halt today with the closing of two banks – Tennessee Commerce Bank of Franklin, TN and […]

First Guaranty Bank and Trust Co of Jacksonville, FL, Closed By Regulators

First Guaranty Bank and Trust Company of Jacksonville, Florida, the oldest bank in Jacksonville, was closed today by state regulators. The FDIC, named as receiver, sold the failed bank to CenterState Bank of Florida, N.A. First Guaranty Band and Trust was a family owned bank with a 62 year history. Inexplicably, according to the Bank’s […]

List Of 2011 Bank Failures Reveals Interesting Facts

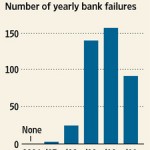

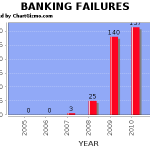

A total of 92 banks failed during 2011, signaling a continuation of the crisis in the banking industry. Although total banking failures during 2011 declined from the previous year, the number remains historically high. The last time more than 50 banks failed in one year was 1992 or 20 years ago. The complete list of […]

Problem Bank List At 20 Year High As Regulators Let Zombie Banks Remain Open

The number of banks on the confidential FDIC Problem Bank List is at a 20 year high. As of September 30, 2011, there were 844 institutions on the Problem Bank List, the largest number since 1992 when the total was 1,066. Since the beginning of the financial crisis in 2008, a total of 417 banks […]

FDIC Issues 72 Enforcement Actions Against Problem Banks In November

The FDIC issued a total of 72 enforcement actions against banks in November 2011, down slightly from 75 in October. Included in the November enforcement actions were 9 civil money penalties, 1 prompt corrective action and 13 consent orders. The FDIC also terminated 37 consent orders and prompt corrective action directives due to either the […]

2011 Bank Failures Decline For First Time In Three Years

For the first time in three years, the number of U.S. banking failures should total less than 100. Total bank closings for 2011 currently total 90. The FDIC has been giving their closing teams some time off, with the last bank closing occurring on November 18, 2011. Bank closings usually occur on Friday and unless […]

FDIC Issues 56 Enforcement Actions In September

A total of 56 administrative enforcement actions were taken by the FDIC against problem banks in September, up from 53 in August. The most serious September enforcement actions taken by the FDIC included 10 consent orders, 3 prompt corrective actions and 16 civil money penalties. Please see the complete list of enforcement actions taken below. […]