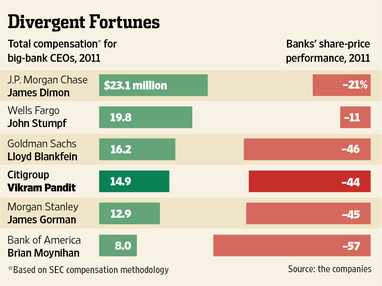

The wide divergence between bank CEO compensation and shareholder returns is an embarrassment to the capitalist notion of linkage between performance and pay.

Shareholders of banking stocks have seen the value of their investments pulverized over the past four years as the banking industry struggles to recover from the lending excesses of previous years. Shareholders of the 445 banks that failed since 2008 have suffered a 100% loss of their investments. The failure of Washington Mutual, the largest banking failure in history, resulted in shareholder losses of over $41 billion when the bank collapsed in 2008.

Despite the miserable financial performance of bank stocks since 2008, CEO of the too big to fail banks have done just fine. Meanwhile, shareholders of banking stocks, who see no reasonable correlation between management compensation and financial performance are justifiably upset.

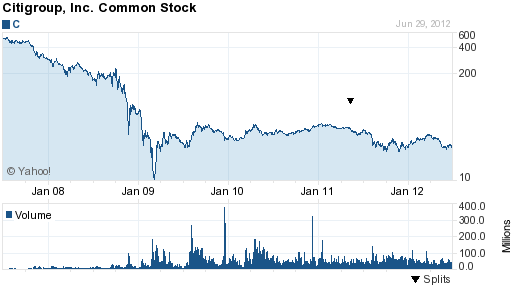

Frustrated shareholders can also expect little help from the Dodd-Frank Act which sought to moderate executive compensation through expanded disclosure requirements. The Act requires a shareholder vote on executive compensation (“say-on-pay”) but the vote is nonbinding which makes the entire shareholder vote a moot process. Citigroup shareholders recently voted down the compensation plan for the Bank’s top executives but the voice of shareholders is likely to be ignored based on the nonbinding nature of the voting process.

Other provisions of the Dodd-Frank Act require an independent compensation committee, prohibits financial incentives that encourages “inappropriate risks”, clawbacks of certain incentive compensation, disclosure of the relationship between financial performance and executive compensation and the relationship of CEO compensation to employee compensation. Many of the specifics related to these new disclosure requirements are still being debated but based on results to date, none of these new requirements are likely to restrain executive compensation for the top executives of the country’s biggest banks.

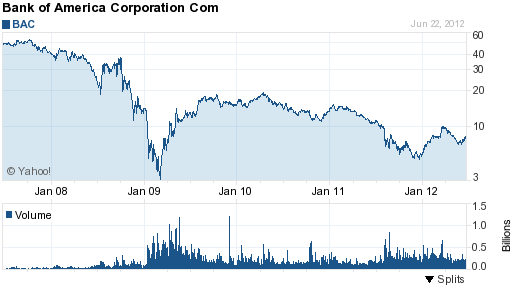

Shown below is an interesting graphic from the Wall Street Journal which compares CEO compensation for six large banks and share price returns since 2011. The results since 2008 are even more appalling with Citigroup’s stock price down almost 95% and Bank of America’s stock price down almost 85%. Instead of wasting time on nonbinding votes, bank shareholders should vote with their feet, sell all positions in these banks and invest in companies with shareholder friendly management.

Source: Wall Street Journal

Citigroup - courtesy yahoo finance

Bank of America - courtesy yahoo finance

Speak Your Mind

You must be logged in to post a comment.