August 20, 2010 – Sonoma Valley Bank, Sonoma, California, was closed today and the FDIC appointed as receiver. To protect depositors, the FDIC sold failed Sonoma Valley Bank to Westamerica Bank, San Rafael, California, which will assume all deposits and purchase essentially all assets of Sonoma Valley Bank.

<!– /* Font Definitions */ @font-face {font-family:Calibri; panose-1:2 15 5 2 2 2 4 3 2 4; mso-font-charset:0; mso-generic-font-family:swiss; mso-font-pitch:variable; mso-font-signature:-520092929 1073786111 9 0 415 0;} /* Style Definitions */ p.MsoNormal, li.MsoNormal, div.MsoNormal {mso-style-unhide:no; mso-style-qformat:yes; mso-style-parent:””; margin:0in; margin-bottom:.0001pt; mso-pagination:widow-orphan; font-size:12.0pt; font-family:”Times New Roman”,”serif”; mso-fareast-font-family:Calibri; mso-fareast-theme-font:minor-latin; mso-fareast-language:ZH-CN;} .MsoChpDefault {mso-style-type:export-only; mso-default-props:yes; font-size:10.0pt; mso-ansi-font-size:10.0pt; mso-bidi-font-size:10.0pt; mso-fareast-font-family:Calibri; mso-fareast-theme-font:minor-latin;} @page WordSection1 {size:8.5in 11.0in; margin:1.0in 1.25in 1.0in 1.25in; mso-header-margin:.5in; mso-footer-margin:.5in; mso-paper-source:0;} div.WordSection1 {page:WordSection1;} –>

Sonoma Valley Bank still owed $8.3 million to the US Treasury for a Troubled Asset Relief Loan (TARP) made in February 2009. In all probability the US taxpayer is looking at a complete loss on the TARP bailout loan. (TARP funding was intended to go only to those institutions that were not at risk of failure but many small banks that received TARP funding are struggling to repay the loans.)

All 3 branches of Sonoma Valley Bank will be opened as usual this weekend and all depositors of Sonoma Valley will automatically become depositors of Westamerica Bank with no interruption in FDIC insurance coverage.

Failed Sonoma Bank had $337.1 million in assets and $255.5 million in deposits. Westamerica will pay a premium of 2.0% to the FDIC on the deposits of Sonoma Valley Bank.

Westamerica has $4.7 billion in assets and is the 7th largest commercial bank headquartered in California, according to the company’s website. Westamerica said in a statement that “Westamerica assumed substantially all deposits of Sonoma Valley Bank. Customers can rest assured their deposits are safe and sound at Westamerica, which is well-capitalized and highly profitable. Sonoma Valley Bank customers will benefit from Westamerica’s broader branch network throughout Northern and Central California, including our ten branches in Sonoma County”.

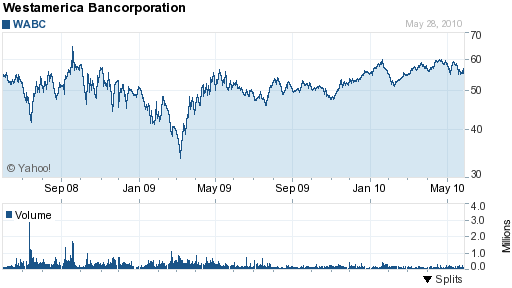

The parent company of Westamerica Bank is Westamerica Bancorporation, a publicly traded company whose stock has recovered from the lows of 2009 as the bank’s earnings recovered.

Sonoma Valley Bank is the 118th banking failure this year. The cost to the FDIC insurance fund for closing Sonoma Bank is $10.1 million. A total of four banks failed in California this week. The other bank failures in California this week were Los Padres Bank of Solvang, Butte Community Bank of Chico and Pacific State Bank of Stockton.

The FDIC does not provide an explanation regarding the loss on closing failed banks but the loss on Sonoma Bank, as a percentage of total assets was small at 2.9%. (See Is The FDIC Understating The Cost Of Bank Failures?) During 2010, the average loss on closing a failed bank has amounted to 23% of a failed bank’s total assets.

Speak Your Mind

You must be logged in to post a comment.