Any bank that can last for 102 years deserves special recognition for surviving business panics, stock market crashes, world wars and economic depressions. The Central Bank of Georgia, Ellaville, GA, is in this category, having been established on September 16, 1910 and surviving until today when the Georgia Department of Banking and Finance closed the Bank.

Central Bank of Georgia’s website notes that five generations of bankers have invested their lives with Central Bank. The Bank also noted that “carefully planned growth” was a hallmark of Central Bank’s management culture and that they expected to “be around for a long time”.

Central Bank of Georgia began as a small-town bank in Ellaville, Georgia, in August of 1910. Though changes occurred in the years that followed, the bank retained that small-town name until October 2003 when it became Central Bank of Georgia. The name change, however, did not change the way the bank has dealt with customers since its beginning: the folks at Central Bank of Georgia believe that customer service comes first and foremost, and a look at their history reveals a successful growth based on this premise.

Central Bank of Georgia plans to be around a long time. Unlike other larger banks looking to sell if their stock hits a pre-determined level, Central Bank has been in business for over 100 years and they have no desire to sell. Closely held, with a long-term commitment to the banking industry and the markets and customers they serve, Central Bank of Georgia is here to stay.

The Bank maintained its roots in the Ellaville community and did not open a branch location until 2000. At the time of closing Central Bank had a total of five branches which will reopen as branches of Ameris Bank, Moultrie, Georgia, which purchased the failed bank from the FDIC.

All depositors of Central Bank will have full access to their money over the weekend through the use of checking accounts, debit cards and ATM facilities. All deposits at Central Bank will continue to be fully insured by the FDIC up to the applicable insurance limits.

At December 31, 2011, Central Bank of Georgia had total assets of $278.9 million and total deposits of $266.6 million. Ameris Bank assumed all deposits of Central Bank and, in addition, agreed to purchase all of the failed bank’s assets.

Ameris Bank and the FDIC entered into a loss-share agreement on $192.8 million of the Central Bank assets purchased by Ameris Bank. The loss-share agreement limits losses on the asset pool acquired by Ameris Bank and is used as a sales incentive by the FDIC in order to sell off failed banks. The FDIC maintains that keeping failed banking assets in the private sector minimizes losses and loan disruptions to customers.

Ameris Bank, owned by holding company parent Ameris Bancorp, has been extremely active in acquiring failed banks since 2009. With the acquisition of Central Bank of Georgia, Ameris has now acquired 9 failed banking institutions of which 8 were located in Georgia and one in Florida.

In our post on the last acquisitions by Ameris Bank in July 2011, it was noted that Ameris Bank had some financial problems of its own although the Bank is rated excellent for capital ratios by depositaccounts.com but has a Texas Ratio of 93% which is considered poor, putting the Bank “at risk”.

Ameris Bancorp, along with 370 other banks, still owes the U.S. Treasury money from the TARP program. (See 370 Problem Banks Remain On US Treasury TARP Life Support). Ameris Bancorp borrowed $52 million under the TARP Capital Purchase Program in November 2008. Ameris has made interest payments on the loan but has not paid back the original $52 million lent to it. Regulators have allowed many banks in the past to purchase failed banks when they still had outstanding TARP loans to the U.S. Treasury (see Banks With Unpaid TARP Loans Buy Failed Banks From FDIC).

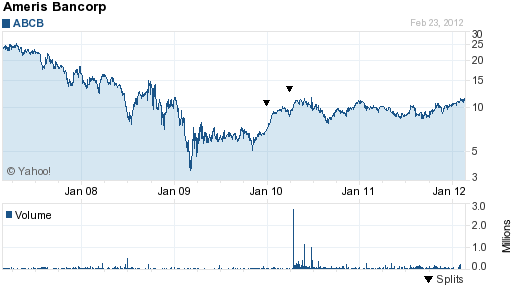

Ameris Bancorp has about $3 billion in total assets and is profitable. Investors in Ameris Bancorp seem optimistic on the Bank’s future. Although the stock price is still far below the high of $25 seen in 2007, the stock price of Ameris Bancorp has more than doubled from its lows of 2009, closing Friday at $11.24.

The loss to the FDIC Deposit Insurance Fund for the failure of Central Bank of Georgia is $67.5 million. Central Bank of Georgia is the nation’s 10th banking failure of the year and the second in Georgia.

Speak Your Mind

You must be logged in to post a comment.