During 2010, 12 different banks with $1.2 billion in outstanding TARP loans to the US Treasury purchased 18 different failed banks from the FDIC.

According to a recent report from the Congressional Oversight Committee, TARP funds totaling $205 billion were distributed to a total of 707 banks. The largest recipients of TARP money have repaid the funds in full, but less than 10% of smaller banks have done so. There are still over 600 banks that have not repaid TARP loans to the US Treasury. Although some of the banks that owe TARP funds are adequately capitalized, the Oversight Committee notes that many of these smaller banks are struggling to raise capital and that many have or will wind up defaulting on the TARP loans.

The list of banks that owe TARP funds and were allowed to purchase failed banks from the FDIC during 2010 are listed below.

| Acquiring Institution | Number of Failed | TARP Loans Unpaid | |

| Banks Purchased | (Millions) | ||

| Ameris Bank, Moultrie, GA | 4 | $ 52.0 | |

| Bank of North Carolina, Thomasville, NC | 1 | $ 31.3 | |

| Citizens South Bank, Gastonia, NC | 1 | $ 20.2 | |

| First California Bank, Westlake, CA | 1 | $ 25.0 | |

| First Midwest Bank, Itasca, IL | 2 | $193.0 | |

| MB Financial Bank, N.A., Chicago, IL | 2 | $196.0 | |

| Manufacturers and Traders Trust Co, Buffalo, NY | 1 | $600.0 | |

| Peoples Bank of East Tennessee, Madisonville, TN | 1 | $ 3.9 | |

| Southern Bank, Poplar Bluff, MO | 1 | $ 9.5 | |

| United Bank, Zebulon, GA | 1 | $ 14.4 | |

| VIST Bank, Wyomissing, PA | 1 | $ 25.0 | |

| Whidbey Island Bank, Coupeville, WA | 2 | $ 26.4 | |

| Totals | 18 | $1,196.7 | |

Why would the FDIC sell failed banks to other banks that are arguably weak, as indicated by the fact that they have still not repaid TARP funds? The FDIC does not generally comment on bank failures but FDIC policy is to seek the least costly resolution method.

After all bidders have completed their due diligence, bidders submit their proposals to the FDIC. This generally occurs 12 to 15 days before the scheduled closing, but it is often as few as 6 or 7 days before closing. To determine the least cost resolution, all bids, including those that do not conform to the FDIC’s previously identified resolution methods (referred to as nonconforming bids) are evaluated and compared with each other and with the FDIC’s estimated cost of liquidation.

By allowing weaker banks that still owe TARP funds to purchase failed banks, the FDIC’s strategy may be an attempt to avoid additional bank failures. The acquiring institution gains access to low cost deposits of the failed bank at a small or zero premium. In addition, many of the failed bank acquisitions have resulted in significant gains for the purchasers, thanks in part to the use of loss-share transactions with the FDIC that protects the acquiring bank from losses.

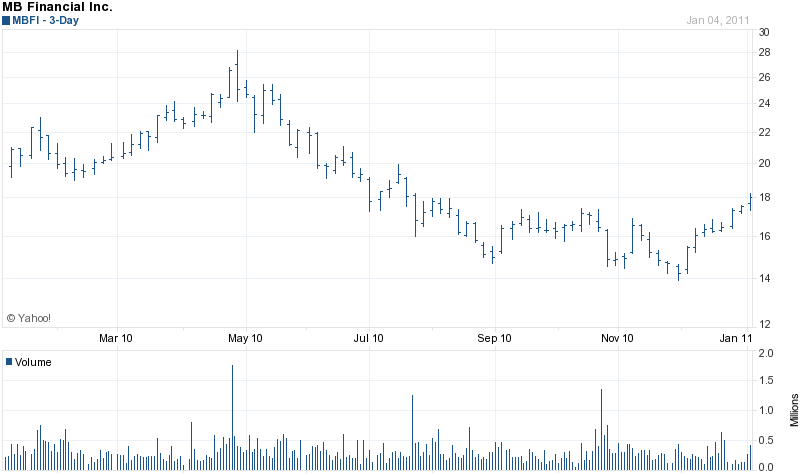

MB Financial, Inc., the holding company for MB Financial Bank, revealed just how profitable the acquisition of failed banks can be under an FDIC “assisted transaction”. MB Financial, in its most recent Form 10-Q disclosed revised estimates “increasing the total gains on the Broadway and New Century FDIC-assisted transactions to approximately $62.6 million. This additional gain was primarily the result of changes to the original estimates related to payment/disposition of assets acquired as we received updated appraisals”. (Broadway and New Century Banks both failed in 2010 and were purchased by MB Financial).

MB Financial still managed to lose $2.8 million for the third quarter of 2010 due to increased provision for loan losses due to depressed business conditions and continued declines in the values of real estate securing loans.

The FDIC’s strategy appears be based on the belief that the combined value of a failed bank and a struggling bank is is greater than the sum of the parts. MB Financial will be an interesting case study of the FDIC’s strategy.

MB Financial is a bank to be worried about, for both investors, depositors and employees. The FDIC assisted transactions have helped masked terrible performance by executive management. With those type of transactions fewer and further between, MB will be unable to dress up their financial results.