August 20, 2010 – ShoreBank, a large and politically well connected Chicago based lender was closed by Illinois regulators who appointed the FDIC as receiver. The failed bank was purchased from the FDIC by the Urban Partnership Bank, Chicago, Illinois, a newly-chartered institution which will wind up owning essentially all of the deposits and assets […]

Palos Bank and Trust Company Of Illinois Closed By Regulators

August 13, 2010 – Palos Bank and Trust Company, Palos Heights, Illinois was closed today by the Illinois Department of Financial and Professional Regulation, which appointed the FDIC as receiver. The FDIC entered into a purchase and assumption agreement with First Midwest Bank, Itasca, Illinois to assume all deposits and purchase essentially all assets of […]

FDIC’s Mountain Of Failed Bank Assets Grow As Five More Banks Collapse

July 30, 2010 – Five more banking institutions collapsed this week in Oregon, Washington, Florida and Georgia. Florida now leads the nation with 20 banking failures, followed by Illinois with 12. All five of this week’s failed banks were acquired by other banking institutions under purchase and assumption agreements with the FDIC acting as receiver. […]

Home National Bank, Blackwell, Oklahoma Closed By OCC

July 9, 2010 – Home National Bank, Blackwell, Oklahoma, was closed today by the Office of the Comptroller of the Currency, which appointed the FDIC as receiver. Home National Bank of Blackwell, Oklahoma with $644.5 million in assets was the week’s largest banking failure. Home National was acquired by RCB Bank, Claremore, Oklahoma, and […]

Four Banks Closed In Maryland, New York And Oklahoma

July 9, 2010 – Regulators closed four banks today – two in Maryland and one in New York and Oklahoma. The four banks had a total of 19 branches and $1.1 billion in assets. The estimated loss to the FDIC Deposit Insurance Fund for the four banking failures amounted to $159.9 million. Three of the […]

FDIC Loss-Share Guarantees Balloon To $177 Billion Putting Taxpayers At Risk

FDIC’s Increased Use Of Loss-Share Program Enriches Some At Taxpayers Expense The FDIC’s use of loss-sharing agreements has grown into a huge multi-billion dollar program that almost guarantees profits for the purchasers of failed banks. Originally introduced in 1991, loss-share agreements have now become a standard tool of the FDIC for moving failed bank assets […]

Sun West Bank Of Las Vegas Runs Out Of Luck

Sun West Bank, Las Vegas, Nevada Closed By Regulators – May 28, 2010 The Nevada Financial Institutions Division closed failed Sun West Bank today and appointed the FDIC as receiver. Sun West’s seven branches will reopen on Tuesday as branches of City National Bank, Los Angeles, CA. The FDIC, as receiver for Sun West, […]

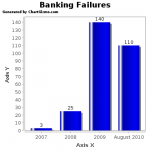

Banking Failures On Track To Exceed 2009 Total As 4 More Banks Fail

4 Banking Failures In 4 States Brings Year’s Total To 72 Four banks in four different states failed today, bringing the year’s total of banking failures to 72. Regulators closed three relatively small banks in Georgia, Michigan and Missouri and one multi-billion dollar bank in Illinois, resulting in total losses to the Federal Deposit Insurance […]

Insiders Reap Huge Profits On Purchase Of Failed South Carolina Bank

Myrtle Beach Bank Failure Results In Fast Profits For Insiders South Carolina saw its first banking failure since 1999 as regulators closed the failed Beach First National Bank of Myrtle Beach. The failed bank had total assets of $585.1 million and total deposits of $516.0 million. The cost to the FDIC Deposit Insurance Fund (DIF) […]

4 Banks Collapse Bringing 2010 Total To 20, OneWest Makes Billions On Failed Bank Purchases

Banking Failures in Texas, California, Illinois and Florida Bring 2010 Total To 20 Regulators continued their ritual of Friday night bank closings, shuttering 4 more banks across the country. The four failed banks had total assets of $4.2 billion and total deposits of $3.4 billion. The cost to the FDIC Deposit Insurance Fund (DIF) […]