August 13, 2010 – Palos Bank and Trust Company, Palos Heights, Illinois was closed today by the Illinois Department of Financial and Professional Regulation, which appointed the FDIC as receiver. The FDIC entered into a purchase and assumption agreement with First Midwest Bank, Itasca, Illinois to assume all deposits and purchase essentially all assets of failed Palos Bank.

The failure of Palos Bank follows 13 previous banking failures in Illinois this year, ranking Illinois as the State with the second highest number of banking failures for 2010 (see Banking Failures by State).

In recent advertisements, Palos Bank seemed to imply that they were in sound condition and noted the bank’s long history of operation: “In these times, it’s vitally important to make sure that your money is in good hands. As an independent community bank, Palos Bank and Trust has a proud history of sound investment advice, caring customer service and innovation in banking spanning over half a century. Come see why families and businesses have come to us for over 50 years with their financial concerns, and why we continue to grow our family of satisfied account holders every year”.

Palos Bank had approximately 140 employees at five branches. All branches will reopen tomorrow as branches of First Midwest and all depositor have uninterrupted access to their accounts. All depositors of Palos will automatically become customers of First Midwest and continue to be insured by the FDIC.

Palos Bank had total assets of $493.4 million and total deposits of $467.8 million. First Midwest will pay the FDIC a premium of 1.0% to assume the deposits of Palos Bank.

The FDIC and First Midwest entered into a loss-share agreement covering $343.8 million of Palos’s Bank’s assets. The loss-share protects First Midwest from losses on the assets it purchased. The FDIC expects that losses on Palos’s assets will be minimized by keeping the assets in the private sector.

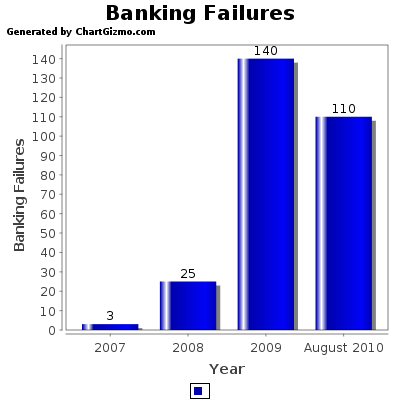

The failure of Palos Bank is expected to cost the FDIC Deposit Insurance Fund $72.0 million. Palos Bank is the 110th banking failure this year and the 14th banking failure in Illinois. The number of bank failures for 2010 is certain to exceed last year’s total based on the present failure rate. During 2009 there were 140 banking failures, the most since 1992. The number of banks on the FDIC’s confidential Problem Bank List has grown dramatically to 775 banks in 2010 from only 47 banks in late 2006.

Speak Your Mind

You must be logged in to post a comment.