November 5, 2010 – Western Commercial Bank, Woodland Hills, California, was closed today by the California Department of Financial Institutions, which appointed the FDIC as receiver. The FDIC entered into a purchase and assumption agreement with First California Bank, Westlake Village, California, to assume all deposits and purchase all assets of failed Western Commercial.

Western Commercial, a small one branch bank, was opened in March 2006, just prior to an epic decline in the value of California real estate values. According to the Bank’s website Western Commercial was an independent community business bank, providing financial services to small and mid-sized businesses, entrepreneurs and professionals in the San Fernando Valley, with special expertise in commercial real estate finance.

Western Commercial, a wholly owned subsidiary of WCB Holdings, Inc. expanded its assets rapidly and by June 2009 had total assets of $122.3 million. The Bank had a loss of $259,000 for the quarter ending June 30, 2009 and planned on raising additional equity capital through a private offering. Besieged by continuing losses and the inability to raise additional capital, regulators issued a Cease and Desist Order in September 2009, citing the bank for its unsafe or unsound banking practices. The Cease and Desist Order cited Western Commercial for operating with inadequate capital, having a large dollar volume of poor quality loans and operating with insufficient liquidity.

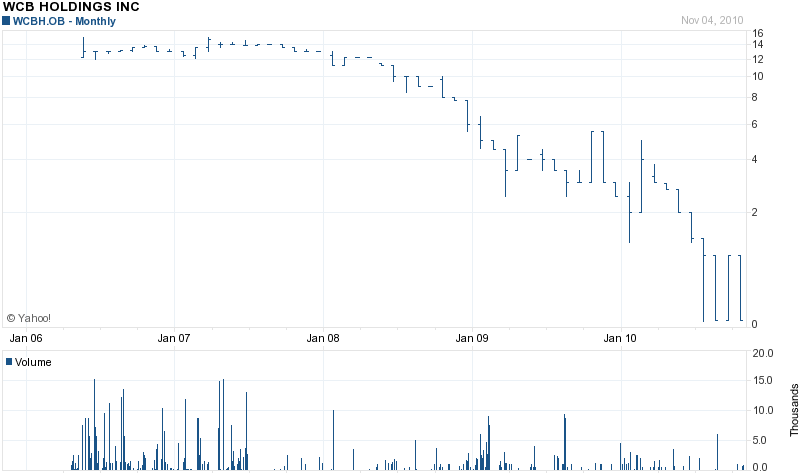

Western Commercial had approximately 350 shareholders, most of them local. The Bank’s failure leaves shareholders with a complete loss on their investment. WCB Holdings last trading at $.07 per share, down from a high of $14 in 2007.

For the six months ending June 30, 2010, Western Commercial incurred net losses of $4.9 million and capital ratios plunged below the minimum levels required by regulators, leading to the bank’s failure.

At September 30, 2010, Western Commercial had total assets of $98.6 million and total deposits of $101.1 million. First California Bank will pay the FDIC a premium of 0.5% for Western Commercial’s deposits. The FDIC and First California entered into a loss-share transaction on $83.9 million of Western’s assets, under which First California will share in the loss on the asset pool acquired.

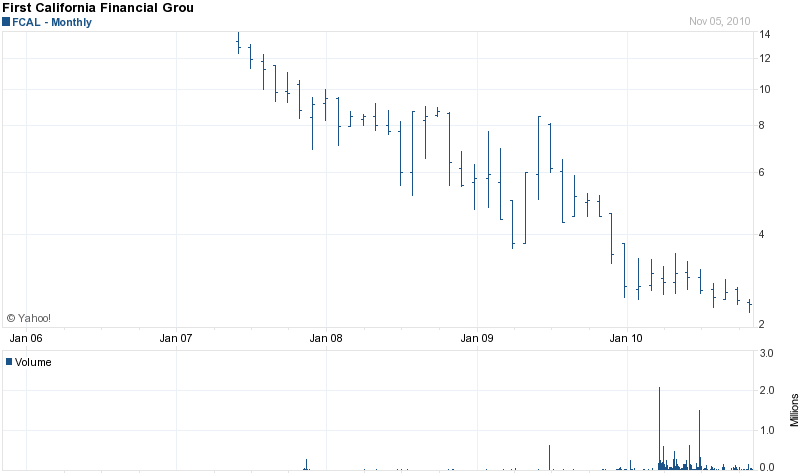

First California Financial Group (FCAL) is the holding company that owns First California Bank. FCAL received $25 million from the US Treasury in December 2008 under the TARP (Troubled Asset Relief Program). Although FCAL has been making timely dividend payments to the US Treasury, FCAL has not repaid the original loan from the US Treasury/Taxpayers. Selling a failed bank to a bank that has received and still owes the US Treasury for TARP money is becoming a common event when the FDIC sells a failed bank. See FDIC Sells 3 Failed Banks to Bailed Out Banks and K Bank Acquired by M&T Bank.

First California, a $1.5 billion dollar asset institution, reported a small profit of $64,000 for the quarter ending September 30, 2010. First California Financial Group’s stock last traded at $2.59, down from $14 per share in 2007.

The loss to the FDIC Deposit Insurance Fund for closing Western Commercial is estimated at $25.2 million or 25% of total assets. Western Commercial is the 141st banking failure of the year and the 11th in California.

Speak Your Mind

You must be logged in to post a comment.