November 5, 2010 – K Bank, Randallstown, Maryland, was closed today by the Maryland Office of Financial Regulation, which appointed the FDIC as receiver. K Bank, the fourth banking failure in Maryland this year, becomes the 140th banking failure of the year. Total banking failures for 2010 now match the 140 banking failures for all of 2009.

M&T Bank, Buffalo, New York, agreed to acquire failed K Bank from the FDIC under a purchase and assumption agreement. Earlier this week M&T Bank acquired $10.4 billion asset Wilmington Trust of Delaware.

M&T Bank will assume all of K Bank’s deposits except for brokered deposits and also agreed to purchase a portion of K Bank’s assets. The seven branches of K Bank will reopen on Saturday and depositors will have full access to their funds. All depositors of K Bank will automatically become depositors of M&T with no interruption in FDIC deposit insurance coverage.

According to K Bank’s website, the bank was established in 1961 and was an SBA (Small Business Administration) Preferred Lender serving the Baltimore metropolitan area with a diverse range of mortgage, construction, commercial and consumer products.

The FDIC issued a Cease and Desist Order to K Bank on April 1, 2009, based on its determination that “the Bank had engaged in unsafe or unsound banking practices and had committed violations of law and/or regulation”. The FDIC cited K Bank for numerous deficiencies including:

- operating with inadequate supervision and loan policies

- operating with inadequate capital and loan valuation reserves

- operating with inadequate liquidity and inadequate internal audit processes

- operating with a large volume of poor quality loans and ineffective interest rate risk policies

- engaging in unsatisfactory lending and collection practices

Given the numerous operating deficiencies of K Bank and the huge amount of poor quality loans that ultimately defaulted, it is reasonable to wonder why regulators allowed K Bank to continue operating for another year and a half before closing the bank. K Bank had a very large troubled asset ratio of 318% compared to the national median of 15.

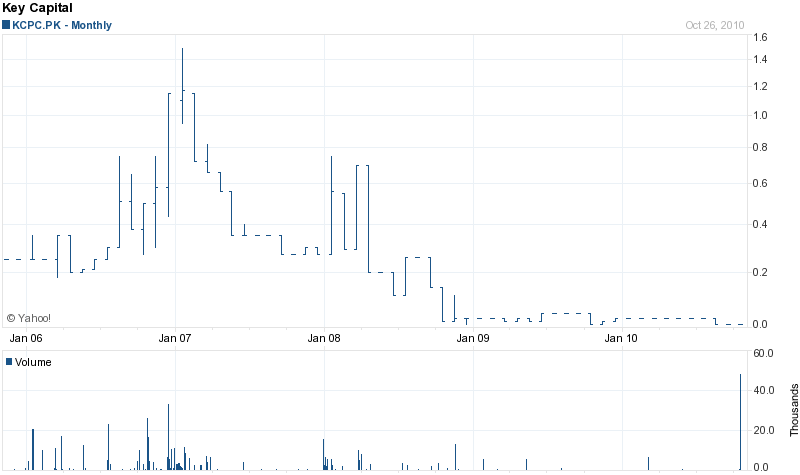

K Bank is owned by K Capital Corporation, a publicly held company whose stock last traded at a fraction of a cent. The common stock investors of K Capital are facing a 100% loss on their investment.

As of September 2010, K Bank had total assets of $538.3 million and total deposits of $500.1 million. M&T Bank did not pay the FDIC a premium K Bank’s deposits. M&T Bank purchased only $410.8 million (76%) of failed K Bank’s assets leaving the FDIC stuck with $127.5 million of poor quality loans to be disposed of at a later date (see FDIC’s Mountain of Failed Bank Assets Grow).

M&T Bank is protected against loss on the purchase of K Bank’s assets through a loss-share transaction entered into with the FDIC that covers $289.0 million of the $410.8 million of assets purchased. The FDIC’s position on loss-share transactions is that by keeping assets in the private sector, returns on failed bank assets can be maximized.

The most noteworthy aspect of K Bank’s failure is the massive loss being taken by the FDIC on K Bank’s assets. The FDIC estimates that the loss to the Deposit Insurance Fund for closing K Bank will be $198.4 million – a shocking 36% of total assets. When the FDIC “calculates the estimated cost of a failure, it takes into account all expected losses” to be incurred on the loss-share transaction and disposition of assets. The real value of K Bank’s assets were far below the value shown on the bank’s balance sheet yet regulators did not require that this valuation loss be recognized on K Bank’s financial statements.

This same situation has been observed with almost every banking failure and was on full display again this week when Wilmington Trust took a huge unexpected writedown on the value of its loan portfolio when it was acquired by M&T Bank. Various accounting rules and regulations are allowing banks to carry assets on their balance sheets at values far in excess of current realizable values. Banking assets may recover value if the economy improves and real estate markets recover, but in the meantime, depositors and investors are left wondering what the true financial condition of a bank really is.

M&T Bank, which has now made three acquisitions of failed banks, owes the US Treasury almost $1 billion dollars under the Troubled Asset Relief Program (TARP).

The directors of K Bank should not to be allowed to just walk away from the debacle and stick the public with the huge bill. Gross negligence or worse was the operating scheme there for years.

This is wide spread. Washington Mutual folded like a cheap card table because of poor management and risky lending practices. Yet management walked away and to date not one charge has been brought. Those losses were much large than the estimated $200M at K Bank.

As a K Bank customer I will say that I’m sad to see this happen. They gave us a loan to build what is now a successful business that employees over 25 full time workers and pumps hundreds of thousands of dollars into the city and local economy. I’m very grateful that they gave us a shot and made starting our business possible. A lot of these larger non-local banks won’t provide the type of lending necessary for small businesses to get started which is vital for a recovery. It sounds like K bank will pay the ultimate price for some poor decisions, but not all their choices were bad ones.

I have an Ira account in k bank. Please provide contact info. I need a statement to file my taxes. My phone# is 443-860-9107, or 410-8788162. I haven’s heard from anyone about my account. Thanks.

It is best to contact your bank directly. Some tax forms are not required to be sent until mid February.