November 2, 2010 – Speculation had been building for the past month over whether troubled Wilmington Trust would sell itself to another bank or be able to raise additional private equity and remain independent.

Wilmington Trust received $330 million from the US Treasury in 2008 under the Troubled Asset Relief Program (TARP) and raised another $274 million earlier this year in a secondary share offering. Additional capital was still necessary, however, due to continuing deterioration in the Bank’s loan portfolio, possible downgrades by the credit rating agencies and potentially adverse regulatory actions.

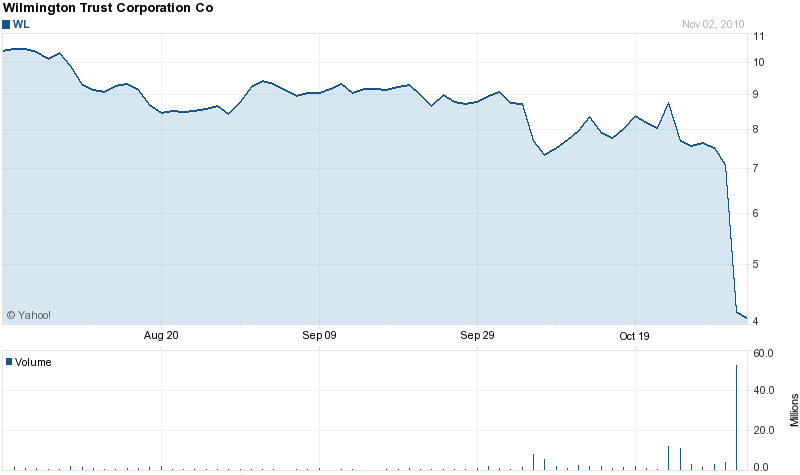

Although Wilmington Trust had reported five consecutive quarters of losses, some analysts were estimating that a potential suitor might pay anywhere from $9 to $15 per share. Wilmington Trust has a profitable wealth advisory group with over $53 billion in assets under management. Although analysts were forecasting another loss for the third quarter in the range of $.33 cents per share, the outlook was that Wilmington would turn a profit sometime in late 2011.

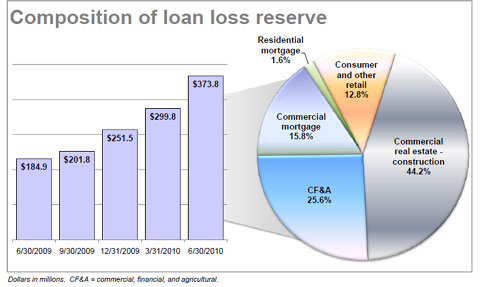

As of the quarter ending June 30, Wilmington had total assets of $10.4 billion with a net loan portfolio of $8.0 billion. Given the heightened level of scrutiny by regulators and auditors over the banking industry, an investor in Wilmington shares might properly assume that adequate loan loss reserves had been established.

In addition, at June 30, Wilmington had capital ratios comfortably above the “well capitalized minimum” levels established by regulators. Wilmington Trust noted that its capital ratios were above regulatory minimums even without counting the US Treasury’s $330 million investment in preferred stock under the Capital Purchase Program. (TARP funds were disbursed to banks in return for preferred stock and warrants from the recipient bank.)

Given the information shareholders had available to them at the end of the second quarter, it was a reasonable assumption that a sale of Wilmington Trust might result in a higher stock price. Shareholders in Wilmington Trust had already seen the value of their shares plummet from $43 to $8 over the past four years. Instead of a reprieve, shareholders got trashed when Wilmington Trust announced third quarter earnings.

Wilmington Trust announced a huge net loss of $4.06 per share for the quarter ending September 30, 2010. Tangible book value was cut in half to $3.84 per share and Wilmington announced that it would sell itself to M&T Bank Corporation for $351 million or $4.00 per share. The primary reason for the loss was “continued deterioration” in Wilmington’s large commercial loan portfolio which represents 85.6% of total loans.

In announcing the dismal results, Wilmington Trust chairman and CEO, Donald E Foley, said:

First, we continued to see credit deterioration in our loan portfolio, reflecting the extent of our exposure to real estate construction lending and its concentration in Delaware.

We have strengthened our credit risk management practices, and our provisioning and reserve levels reflect the increased risk in our loan portfolio, Mr. Foley added. However, there is no significant economic or real estate recovery on the horizon in our markets. Therefore, we have little assurance that our loan portfolio will strengthen significantly in the near term, or that our capital position will not erode further. These risks increase the possibility of downgrades by the credit rating agencies or adverse regulatory actions which could compromise our businesses.

Wilmington Trust’s highlights for the third quarter (below) portray a very grim outlook for a bank that many thought was on the road to recovery.

- Appraisals continued to show declines in collateral values and the financial condition of borrowers weakened

- Total nonperforming assets increased 77% to $988.6 million – 12.1% of total loans

- Loans with substandard risk ratings totaled $2 billion, up 37%

- Provision for loan losses increased 37%

- Demand for new loans remains weak

With investors already nervous about banks, as evidenced by large declines in the share prices of many banks, the Wilmington Trust bombshell is certain to raise additional concerns about the quality of bank earnings and loan portfolios. There are thousands of banks with major exposure to commercial real estate. The obvious implication of the Wilmington Trust fiasco is that many more financial institutions may be in much worse financial condition than either bank management or regulators will admit.

Speak Your Mind

You must be logged in to post a comment.