September 17, 2010 – After closing only one bank since August 20th, regulators picked up the pace and closed six banking institutions. With the recent increase in the number of banks on the FDIC’s “Problem Bank List“, regulators should be busy well into 2011 closing institutions that are considered “unsafe and unsound”.

As of the latest report released by the FDIC there were 829 problem banks at June 30, 2010 up from 775 at March 31. The historic low for the Problem Bank List was reached in the third quarter of 2006 with 47 banks. The FDIC’s Problem Bank List of 829 banks is the largest number since March 31, 1993 when there were 928. Problem Banks now account for over 10% of all banking institutions.

In general, banks included on the Problem Bank List have serious deficiencies with their finances, operations, or management that threaten their continued solvency. Once a bank is included on the list, they are subject to closer regulatory scrutiny.

Making matters, worse the dramatic increase in the number of banking failures over the past two years has depleted the FDIC Deposit Insurance Fund (DIF), which protects depositors in the event of bank failures. The DIF is presently at negative $15.2 billion despite increases in the assessment rate on banks to replenish the fund. The FDIC DIF is now insuring $5.5 trillion of bank deposits with a negative fund balance. The leisurely rate of bank closings, despite a large increase in the number of Problem Banks, may coincide with a reluctance by the FDIC to avoid further depletion of the DIF.

The FDIC has publicly acknowledged that the DIF must not be allowed to fall to dangerously low levels.

The FDIC believes that it is important that the fund not decline to a level that could undermine public confidence in federal deposit insurance. A fund balance and reserve ratio that are near zero or negative could create public confusion about the FDIC’s ability to move quickly to resolve problem institutions and protect insured depositors.

FDIC DIF FUND

The six banks closed today had total assets of over $1.3 billion dollars and the loss to the FDIC Deposit Insurance Fund is estimated at $347.6 million, as detailed below. Please click on link for detailed information on each bank closing.

| Failed Bank | Total Assets | Loss To DIF | ||||

| (Millions) | (Millions) | |||||

| #120 ISN BANK | $ 81.60 | $ 23.90 | ||||

| #121 BANK OF ELLIJAY | $ 168.80 | $ 55.20 | ||||

| #122 FIRST COMMERCE | $ 248.20 | $ 71.40 | ||||

| #123 THE PEOPLES BANK | $ 447.20 | $ 98.90 | ||||

| #124 BRAMBLE SAVINGS | $ 47.50 | $ 14.60 | ||||

| #125 MARITIME SAVINGS | $ 350.50 | $ 83.60 | ||||

| $ 1,343.80 | $ 347.60 | |||||

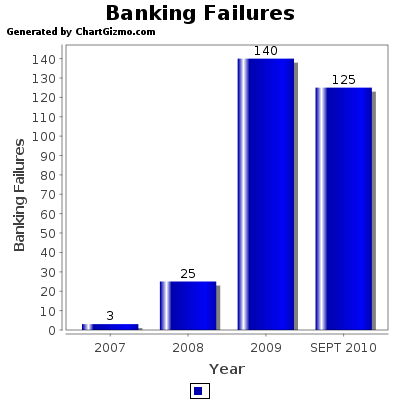

The total number of banking failures is fast approaching last year’s total of 140 which was the highest number since 1992.

BANK FAILURES BY YEAR

Speak Your Mind

You must be logged in to post a comment.