New Horizons Bank, East Ellijay, Georgia, was closed today by the Georgia Department of Banking and Finance which named the FDIC as receiver. The FDIC entered into a purchase and assumption agreement with Citizens South Bank, Gastonia, North Carolina, to assume all deposits and purchase all assets of failed New Horizons.

New Horizons was a small locally owned and operated community bank with total assets of $110.7 million at December 31, 2010. Smaller banks, besides having to comply with many new and costly regulations, have found it difficult to impossible to raise additional capital as loan losses have mounted and property markets remain weak. New Horizons had a troubled asset ratio of 414% and typically a bank with a troubled asset ratio over 100% winds up failing.

New Horizons had only one branch which will reopen on Monday as a branch of Citizens South. Depositors will have full access to their money over the weekend by writing checks or using debit cards or the ATM.

New Horizons had total deposits of $106.1 million on which Citizens South will pay the FDIC a premium of 1.0%.

Citizens and the FDIC entered into a loss-share transaction on $84.7 million or 76.5% of the asset pool from New Horizon purchased by Citizens. The FDIC maintains that by keeping assets in the private sector, the ultimate loss on the failed bank’s assets are minimized.

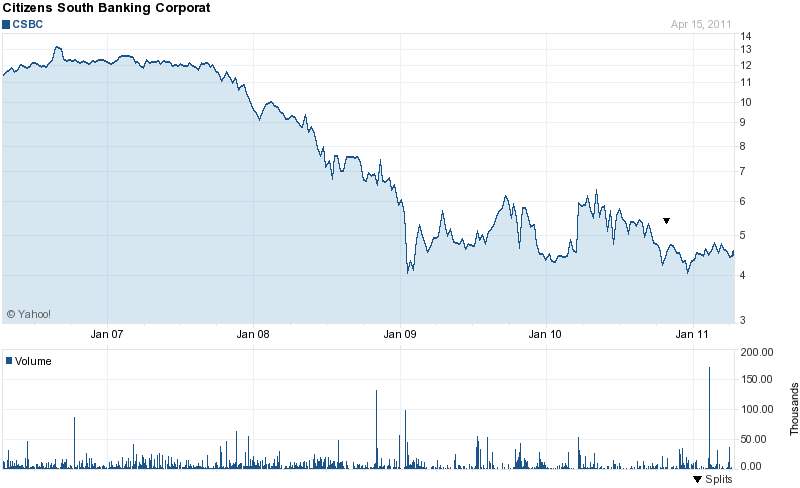

Citizens South Bank was founded in 1904, has assets of $1.1 billion and 21 banking offices. The parent company is Citizens South Banking Corporation, which according to ProPublica, still owes the taxpayers $20.5 million that was lent to them under the TARP program. Although apparently unable to repay the TARP loan, Citizens South manages to pay its shareholders $.04 cents per share.

There are numerous examples of the FDIC allowing the purchase of failed banks by banks that still owe the U.S. taxpayer monies extended under the TARP program (see Banks With $1.2 Billion in Unpaid TARP Loans Buy 18 Failed Banks). The FDIC has never provided an explanation for allowing banks with unpaid TARP funds to purchase failed banks.

Investors have not been impressed with the performance of Citizens South and its stock still trades at levels reached during the height of the banking crisis in early 2009.

This is the second purchase of a failed bank by Citizens South, having purchased failed the Bank of Hiawassee in 2010.

The estimated loss to the Deposit Insurance Fund on the failure of New Horizons is $30.9 million. New Horizons is the nation’s 30th banking failure for 2011 and the eight in Georgia which has the highest number of banking failures in the nation.

Speak Your Mind

You must be logged in to post a comment.