January 7, 2011 – Legacy Bank of Scottsdale, Arizona, was closed today by the Arizona Department of Financial Institutions, which appointed the FDIC as receiver. The FDIC, acting as receiver, sold failed Legacy Bank to Enterprise Bank & Trust, St. Louis, Missouri. Enterprise will assume all deposits and purchase essentially all assets of failed Legacy Bank. The two branches of Legacy Bank will reopen on Monday as branches of Enterprise Bank.

Legacy Bank was a small size bank with only $150 million in assets. The Bank was relatively new, established in early 2005, shortly before real estate markets began to crash in Arizona. Total assets at Legacy Bank ballooned from around $100 million in 2005 to over $240 million in 2008. Legacy’s website highlighted the Bank’s commitment to to personal service.

Being a private bank means performing banking services a bit differently than other banks. It means going the extra mile for our clients, who we consider members of the Legacy family. Our banking philosophy puts people first, transactions second.

At September 30, 2010, Legacy had total assets of $150.3 and total deposits of $125.9 million. Enterprise will pay the FDIC a premium of 1.0% to assume the deposits of Legacy. In addition, Enterprise will purchase all of Legacy’s assets. The FDIC and Enterprise entered into a loss-share agreement covering $119.8 million (80%) of the purchased assets which will limit loss exposure to Enterprise.

Legacy Bank is the second banking failure of 2011 and will cost the FDIC Deposit Insurance Fund $27.9 million.

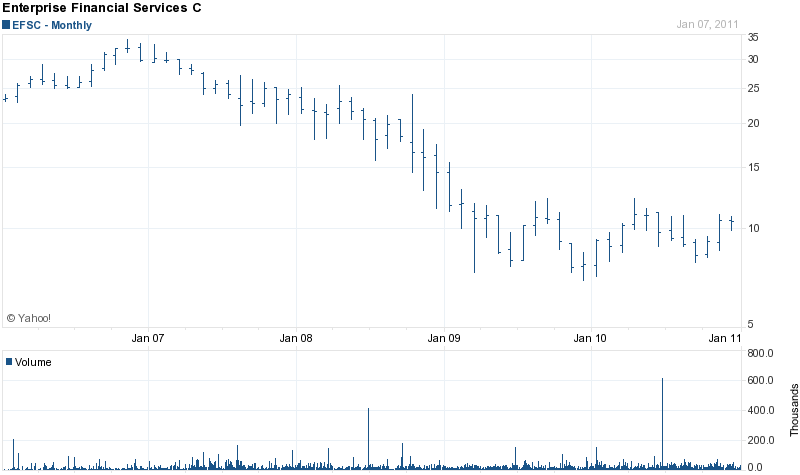

The FDIC continues with its strategy of selling failed banks to banks with unpaid Troubled Asset Relief Program (TARP) loans (see Banks With $1.2 Billion in Unpaid TARP Loans Buy 18 Failed Banks from FDIC). Enterprise Bank & Trust is owned by $2.5 billion asset holding company Enterprise Financial Services Corp. which still owes the US Treasury $35 million dollars loaned to them under the TARP program.

Enterprise was involved in two previous FDIC assisted transactions including the purchase of failed Valley Capital Bank of Mesa, AZ in December 2009 and the purchase of failed bank assets from the FDIC in July 2010, both of which were highly profitably to Enterprise. The third quarter press release from Enterprise discloses the impact on earnings from the FDIC transactions.

On July 9, 2010, the Company acquired approximately $260 million in Arizona-originated assets from the FDIC in connection with the failure of Home National Bank (“HNB”) of Blackwell, Oklahoma. The assets were purchased at a 12.5% discount and are covered by a loss share agreement with the FDIC. The asset purchase was the Company’s second FDIC-assisted transaction in Arizona.

Pre-tax, pre-provision income from continuing operations was $16.4 million in the third quarter of 2010, nearly double the $8.6 million reported for the prior year period and 70% higher than the second quarter of 2010. The HNB asset purchase contributed approximately $5.8 million to third quarter pre-tax, pre-provision income.

Peter Benoist, President and Chief Executive Officer, commented, “For the third consecutive quarter, the Company has grown pre-tax, pre-provision operating earnings. Our Arizona asset purchase from the FDIC contributed substantially to our third quarter results. While these results are indeed encouraging and the early favorable results from our Arizona acquisitions bode well for future earnings, we do not yet see significant signs of recovery, particularly in the housing and commercial real estate markets,” continued Benoist. “As a result, we expect nonperforming asset levels to remain elevated.”

In a separate press release regarding the acquisition of Legacy Bank, Enterprise management forecasts that the FDIC assisted transaction will “add approximately $.15 to $.20 to Enterprise’s 2011 earnings per share.”

As previously discussed, the FDIC’s strategy seems to be based on the belief that the combined value of a failed bank and a struggling bank is greater than the sum of its parts.

“By allowing weaker banks that still owe TARP funds to purchase failed banks, the FDIC’s strategy may be an attempt to avoid additional bank failures. The acquiring institution gains access to low cost deposits of the failed bank at a small or zero premium. In addition, many of the failed bank acquisitions have resulted in significant gains for the purchasers, thanks in part to the use of loss-share transactions with the FDIC that protects the acquiring bank from losses.”

Perhaps after a few more failed bank acquisitions, Enterprise will be able to repay the $35 million owed to the taxpayers under the TARP. Ironically, Enterprise Financial is paying its stockholders an annual dividend of $.21.

Speak Your Mind

You must be logged in to post a comment.