Inter Savings Bank, Maple Grove, Minnesota, was closed today by the Office of the Comptroller of the Currency which appointed the FDIC as receiver. The FDIC sold the failed bank to Great Southern Bank, Reeds Spring, Missouri, which will assume all deposits of failed Inter Savings Bank.

Inter Savings Bank, (fsb D/B/A Interbank) which had been in business since 1965, was a relatively large bank with almost half a billion dollars in total assets. Originally founded as Falls Federal Savings and Loan, the Bank expanded its operations to include branch offices in Florida. The Bank was purchased by a group of investors in the early 1990’s and the name was changed to InterBank. Over its 30 years of operations, InterBank became one of the largest community banks in Minnesota with over $500 million in assets.

Unfortunately many of the assets held by Inter Savings Bank consisted of defaulted loans. The Bank had a very high troubled asset ratio of 244%. Typically, a bank with a troubled asset ratio in excess of 100% almost always winds up as a failed bank.

All four branches of Inter Savings will reopen on Monday as branches of Great Southern Bank and FDIC deposit insurance will continue up to the applicable limits. Over the weekend, depositors of Inter Savings will have access to their money through the use of checking, ATMs and debit cards.

At December 31, 2011, Inter Savings had total assets of $481.6 million and total deposits of $473.0 million. Great Southern Bank agreed to purchase virtually all of the assets of failed Inter Savings, subject to a loss-share transaction with the FDIC which will limit the losses to Great Southern on the asset pool purchased. The loss-share transaction between the FDIC and Great Southern will cover $413 million of the asset pool acquired.

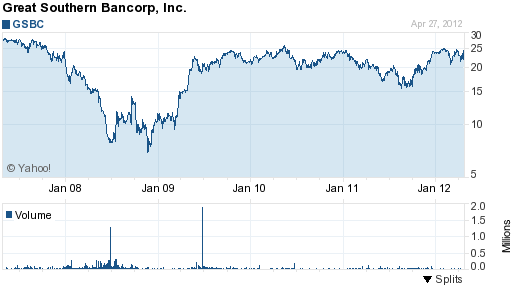

Great Southern Bank, founded in 1923, is profitable and has over $3.8 billion in assets. The holding company for Great Southern is Great Southern Bancorp, Inc. which is a publicly traded company. The Bank pays over a 3% dividend yield and its stock price has recovered to levels seen before the economic crash of 2008. Great Southern Bank had previously purchased two other failed banks during 2009.

The FDIC defends the use of loss-share transactions as a means of maximizing returns on failed bank assets by keeping them in the private sector. In addition, absorbing a portion of the losses on failed bank assets is a big incentive to attract purchasers of failed banks. If the FDIC cannot find a buyer for a failed bank, losses are usually greater and depositors with balances in excess of insurance deposit limits are subject to losses on their savings. This situation happened today when the FDIC was not able to find a buyer for the failed Bank of the Eastern Shore in Maryland.

The estimated loss to the FDIC Deposit Insurance Fund is $117.5 million. InterBank becomes the nation’s 20th banking failure of the year and the third in Minnesota.

Speak Your Mind

You must be logged in to post a comment.