Would you invest almost all of your money in Flagstar Bancorp?

Would you invest almost all of your money in Flagstar Bancorp?

Managing investment risk through diversification is often cited as one of the most important rules for successful investment. The future performance of a company is impossible to reliably predict since it is subject to countless unknown variables.

Since the future prospects of a business cannot be predicted, investors hedge themselves by diversifying. A stock that crashes but is only 1% of a portfolio won’t usually make much of a dent in overall investment returns. A portfolio with over 60% of its holdings in one stock is likely to either blow up or produced some extraordinary gains.

So why would anyone take the huge risk of making a concentrated bet on one stock? One reason would be if you’re not investing your own money as we can see in the interesting case of Flagstar Bancorp (FBC).

FBC is one of the nation’s biggest residential mortgage originators and has total assets of almost $10 billion. During the second quarter of 2014 FBC had net income of $25.5 million compared to a loss of $78.9 million in the first quarter and net income of $65.8 million in the comparable quarter of 2013. Book value per common share increased to $19.90 at June 30, 2014, up from $17.66 at June 30, 2013.

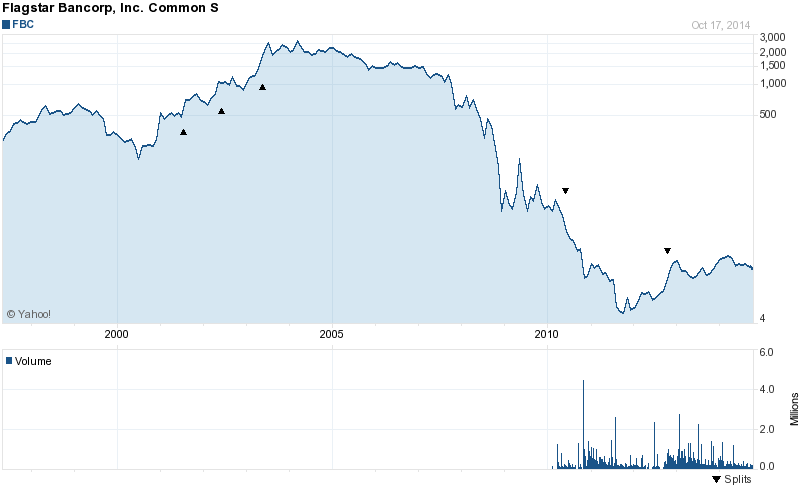

FBC has recovered significantly from the dark days of the financial crisis but its stock is still far below the levels seen in 2008. Earning for the third quarter of 2014 are due to be released on October 21, 2014 after the market closes.

Probably no one will be more interested in Flagstar’s financial results than MP Thrift Global Advisors III LLC which holds a really large position in FBC. Hedge funds are required to disclose holdings on a quarterly basis by filing Form 13-F with the SEC but they don’t have to say why they invest in a particular company.

Flagstar’s stock is widely held by both institutions and mutual funds but the holdings of MP Thrift Global Advisors is off the charts with them holding over 63% of all outstanding shares of FBO.

Why MP Thrift Global Advisors holds such a huge position in FBO is not known but they are obviously bullish on the stock. We should get a better read on whether or not this bullishness is warranted on October 21st.

Speak Your Mind

You must be logged in to post a comment.