The 46th banking failure of 2012 occurred today as the Missouri Division of Finance closed Excel Bank, Sedalia, Missouri. The FDIC, named as receiver, sold the failed bank to Simmons First National Bank, Pine Bluff, Arkansas, which will assume all deposits of the failed bank.

Excel Bank, which had been in business since 1964 had four branches, all of which will reopen Saturday as branches of Simmons Bank. All depositors of failed Excel Bank will automatically becomes depositors of Simmons First National Bank with uninterrupted FDIC deposit insurance. Depositors of Excel will be able to access their money today and over the weekend through the use of checking accounts, debit cards and ATMs.

Excel Bank has been a troubled institution for years. In March 2010, the Bank signed a Consent Order with the FDIC agreeing to cure numerous managerial and financial deficiencies and raise additional capital. Similar to many other small problem banks, Excel was unable to raise additional capital and a very high level of nonperforming loans eventually caused Excel to become critically undercapitalized.

At June 30, 2012, Excel Bank had a ridiculously high troubled asset ratio of 341% compared to a national average of 12%. Banks with a troubled asset ratio in excess of 100% almost invariably are unable to recover and wind up failing. The troubled asset ratio at Excel Bank had been in excess of 100% since early 2011 but regulators seem willing to allow problem banks an exceptional grace period in which to turn things around. In the case of Excel Bank, that never happened.

As June 30, 2012, Excel Bank had total deposits of $187.4 million and total assets of $200.6 million. Simmons First National Bank agreed to purchase Excel’s assets subject to a loss-share transaction with the FDIC under which a portion of the losses on the failed asset pool will be absorbed by the FDIC. The loss-share agreement covers $126.6 million of the asset pool acquired by Excel Bank. The FDIC maintains that losses are ultimately minimized by the use of loss-share agreements which keep failed banking assets in the private sector and minimizes disruptions to loan customers.

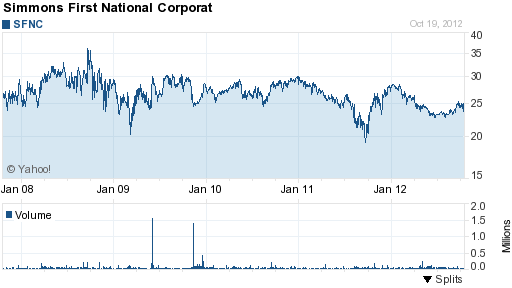

Simmons First National Bank is owned by its holding company Simmons First National Corporation which has over $3.3 billion in total assets and is considered well capitalized. Including Excel Bank, Simmons has now acquired four failed banks in FDIC assisted transactions. According to a news release by Simmons First National Corporation, the acquisition of Excel Bank will be immediately profitable.

SFNB has entered into a purchase and assumption agreement with the FDIC to purchase $201 million in assets and assume all of the deposits and substantially all other liabilities, at a discount of $21.0 million and no deposit premium. The final valuation and purchase price of acquired assets and liabilities will be determined upon completion of appropriate valuation processes.

This transaction is expected to be immediately accretive to SFNC’s net income and diluted earnings per

common share. Upon completion of the acquisition, SFNC will continue to remain substantially above the threshold for “well capitalized” under regulatory capital standards. Simmons First has a long history of consistent earnings, strong capital and excellent asset quality. No additional capital is required to support this transaction.

The loss to the FDIC Deposit Insurance Fund for the failure of Excel Bank amounts to $40.9 million. Excel Bank is the 46th banking institution to fail this year and the 3rd in Missouri.

Speak Your Mind

You must be logged in to post a comment.