Banking Failures – 106 And Counting Banking regulators have been closing banks at a leisurely pace over the past two weeks despite the fact that many analysts expect upwards of 1,000 additional banks to fail based on their poor financial condition and mounting loan losses. The FDIC Problem Bank List currently includes 416 banks with […]

Three Failed Banks For October 2, 2009 – Warren Bank Example Of Regulatory Failure

Banking Failures – 98 And Counting 2009 has now seen a total of 73 more failed banks than occurred for all of 2008. The latest banking closures bring total banking failures for 2009 to 98. The latest three failed bank on October 2, 2009 had total assets of $634 million and total losses to the […]

FDIC To Bolster Insurance Fund With Prepaid Bank Assessments

FDIC To Increase DIF By $45 Billion The FDIC announced today a proposal to increase the deposit insurance fund (DIF) by requiring financial institutions to prepay three years of assessments. The collection of prepaid assessments will allow the FDIC to cover the cost of future banking failures without tapping their credit line with the US […]

FDIC Seeks To Avoid Treasury Bailout

The FDIC Board of Directors will meet today to discuss the Deposit Insurance Fund Restoration Plan, assessments and funding. As the number of banking failures continues to increase, it has become obvious that the current amount of reserves ($10.4 billion) in the FDIC deposit insurance fund (DIF) are totally inadequate to cover expected FDIC losses […]

One Failed Bank For September 25, 2009

Banking Failures – 95 And Counting 2009 has now seen a total of 70 more failed banks than occurred for all of 2008. The latest banking closure brings total banking failures for 2009 to 95. The latest failed bank on September 25, 2009 had total assets of $2 billion and total losses to the FDIC […]

Is It Safe?

Should you keep your money in an FDIC insured problem bank? Or are you asking for trouble? As of the latest report released by the FDIC there were 416 problem banks at June 30, 2009, up from 117 the previous year and up from 305 on March 31, 2009. Total assets held by the […]

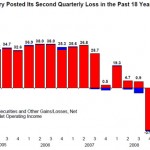

Is The Banking Industry Collapsing Or Improving? – Charts Provide Some Insights

Banking Industry – Recovery or Another Bailout? The latest FDIC Quarterly Banking Profile shows a banking industry still in turmoil, as non performing loans reached all time highs. The banking industry reported an aggregate net loss of $3.7 billion in the latest quarter ending June 30, 2009 compared to a year ago quarterly profit of […]

FDIC 2009 Second Quarter Banking Profile

Quarterly Banking Profile, June 30, 2009 On August 27, 2009, the FDIC released their Quarterly Banking Profile for the Second Quarter of 2009. The Banking Profile depicts a banking industry that continues to struggle as shown by deteriorating loan quality, an increased number of banks on the Problem Bank List, a declining FDIC Insurance Fund, […]

Corus Bankshares – September Closing Would Be In Top Five Banking Failures For 2009

Bidding Deadline Set For Corus – Closure Expected In September Reuters is reporting a bidding deadline for problem bank Corus Bankshares of September 3, 2009. The disclosure of a bidding deadline followed shortly by a bank closure follows the procedure recently observed with the closing of Guaranty Financial Group last week. The closing of Corus […]

Analyst Predicts Up To 200 More Banking Failures

Banking Failures Continue Banks are facing numerous problems in the current banking crisis. Mortgage defaults continue to rise to unprecedented levels, commercial loans are forecast to be the next black hole in bank balance sheets and loan volume continues to contract. The FDIC has been closing banks at what appears to be a leisurely pace […]