The latest national housing survey conducted by Fannie Mae shows that many Americans expect to see both higher mortgage rates and rising home prices over the next year. It will be interesting to see how this paradox unfolds since an increase in mortgage rates has typically made housing less affordable to buyers. One scenario under […]

Almost Half of Americans Expect Higher Mortgage Rates and Higher Home Prices

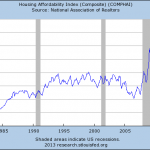

The Average Family Can Now Afford To Own Two Houses

The combination of all time lows in mortgage rates along with the collapse in real estate values has resulted in all time record housing affordability. During the inflation racked 1980’s, interest rate increases by the Federal Reserve resulted in double digit mortgage rates. High mortgage payments froze most home buyers out of the housing market […]

Housing Market Unlikely To Boost Economic Recovery In 2013

Although the economy grew in the third quarter, data continues to show a “sluggish recovery overall” according to Fannie Mae’s Economic & Strategic Research Group. Total growth in U.S. gross domestic product since the lows of 2009 has been 7.2% compared with average growth of 16% for previous economic recoveries since the 1960’s. Despite the […]

Group Think On Housing Recovery May Be Premature

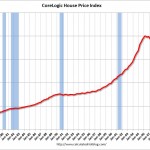

Almost daily the mainstream news media is proclaiming that the housing crisis is over. A recent Wall Street Journal front page article boldly proclaimed “The Housing Bust Is Over.” No less an authority than Warren Buffett has suggested that housing has become a compelling investment opportunity. Tops and bottoms in any market are not usually […]

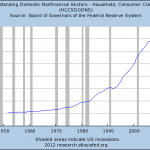

Net Worth of American Households Plunges By $2.4 Trillion In Third Quarter

Those looking for a rebound in either real estate prices or the wealth of the American consumer were sorely disappointed after the release of the Federal Reserve’s Flow of Funds Accounts for the third quarter 2011. The net worth of Americans plunged by $2.4 trillion in the third quarter. Keep in mind that the entire […]