Last week had no bank closings due to the holiday weekend. Regulators returned to work today, closing five insolvent banks in Florida, Georgia and Michigan. A total of 39 banks have now failed during 2011.

Although the banking industry has recovered from the dark days of the financial crisis due to unprecedented government aid, the FDIC still has 884 banks on its unofficial Problem Bank List.

The problem banks have combined assets of $390 billion and comprise almost 12% of all FDIC insured institutions. While larger banks with multiple revenue sources have been able to rebuild capital, smaller banks are still struggling due to very slow loan growth and the continued decline of values in residential and commercial real estate.

The five banks closed today by banking regulators were First National Bank of Central Florida, Florida, Cortez Community Bank, Florida, First Choice Community Bank, Georgia, The Park Avenue Bank, Georgia, and Community Central Bank of Michigan.

Larger banks with strong capital positions have been able to acquire deposits, build market share and increase their loan portfolios by acquiring failing banks from the FDIC.

Bank of the Ozarks, based in Little Rock, Arkansas, has been one of the biggest acquirers of failed banks and continued its buying spree today with the purchase of two additional failed banks. The two failed banks purchased by Bank of the Ozarks were First Choice Community Bank of Dallas, Georgia, and The Park Avenue Bank of Valdosta, Georgia.

Today’s acquisition of two failed banks by Bank of the Ozarks gave them $1.25 billion in assets backed by FDIC loss-share agreements that cover $774.8 million or 62% of the failed bank assets purchased. The loss-share agreements limit the loss on the acquisition of the failed banks’ loan portfolios. The FDIC offers loss-share transactions to entice buyers to purchase failed banks and keep assets in the private sector. Bank of the Ozarks also acquired 19 branch offices and $1.14 billion in new deposits from the two failed banks.

Bank of the Ozarks has now acquired seven banks since 2010. The five previously completed failed bank acquisitions were Oglethorpe Bank of Georgia, Unity National Bank of Georgia, Woodlands Bank of South Carolina, Horizon Bank of Florida and Chestatee State Bank of Georgia.

Bank of the Ozarks, with over $3 billion in assets, is well capitalized and now has over 100 offices in Arkansas, Georgia, Texas, Florida, North Carolina, South Carolina and Alabama. George Gleason, CEO of Bank of the Ozarks, said “We are considered one of the strongest and best capitalized banks in the country”.

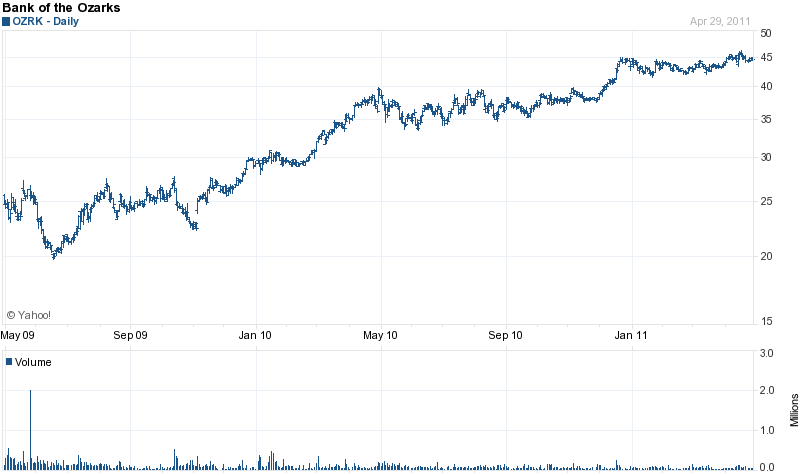

Since early 2009, Bank of the Ozarks has seen its stock price more than double and pays a dividend of 1.6%.

Two of today’s failed banks (Cortez Community and First National Bank of Central Florida) were acquired by Florida Community Bank which is a division of Premier American Bank, N.A.

Premier American Bank was newly chartered in early 2010 and established for the express purpose of purchasing failed banking enterprises. Premier American Bank is a subsidiary of Bond Street Holdings, LLC, Naples Florida, which had raised over $400 million in private investment money to invest in failed banks. Due to the large number of banking failures over the past three years, private investment groups were allowed to purchase failed banks by the FDIC. Many private investors in failed banks have made multi billion dollar profits due in large part to generous loss-share transactions provided by the FDIC.

Premier American Bank has built itself into a healthy banking empire with over $3 billion in assets acquired from failed banks. Premier American had previously acquired four failed banks.

With today’s acquisition of Cortez Community and First National Bank of Central Florida, Premier American acquired eight bank branches and banking deposits of $373.5 million. Premier American also acquired $423 million in assets from the two failed banks. The FDIC entered into loss-share transactions with Premier American covering $321 million of the asset pool purchased.

This week’s fifth banking failure, Community Central Bank, Michigan, was acquired by Talmer Bank and Trust, Troy, Michigan, which assumed all deposits and purchased all assets. Community Central Bank, which had $476 million in assets, becomes the nation’s 39th banking failure. Community Central was hopelessly insolvent with nearly half of the assets held on its books being worthless. The poor financial status of Community Central was revealed when the FDIC disclosed that the loss on the closing of Community Central was estimated at $183.2 million – an amazing 38.5% of total assets.

The five failed banks had total assets of $2.2 billion and will result in an estimated loss to the FDIC Deposit Insurance Fund of $643.2 million. Total losses for the 39 banking failures of 2011 is $3.1 billion.

Speak Your Mind

You must be logged in to post a comment.