January 14, 2010 – The Georgia Department of Banking and Finance closed Oglethorpe Bank, Brunswick, Georgia, today and appointed the FDIC as receiver. The FDIC entered into a purchase and assumption agreement with Bank of the Ozarks to assume all deposits of Oglethorpe Bank.

The two branches of Oglethorpe Bank will reopen on Saturday as branches of Bank of the Ozarks and deposits will continue to be fully insured by the FDIC. Bank depositors will continue to have full access to their money through the use of checks, ATM or debit cards.

Oglethorpe was a locally owned small community bank with $230.6 million in total assets and $212.7 in total deposits. According to the Bank’s website:

Oglethorpe Bank was founded by the Board of Directors, with the help and contributions of our many shareholders, in the summer of 2003. From our beginning in Brunswick Georgia, we will strive to be recognized as one of the leading banks in our industry. Our main office location is statistically located at 3344 Cypress Mill Road in Brunswick Georgia.

As Oglethorpe Bank approaches the future, our success will depend upon our efforts to work toward achieving our business goals. We will provide our customers excellent quality service, achieve above average profits and conduct all transactions with confidentiality and professionalism.

Oglethorpe experienced a dramatic decline in financial condition due to a very high level of loan defaults. The Bank had a troubled asset ratio of 560% compared to a national average of 15%. A troubled asset ratio over 100% usually results in a bank’s failure. The Bank’s capital ratios all plunged well below regulatory minimums since 2009 as the bank’s loan portfolio imploded. At September 30, 2010, Oglethorpe’s total risk based capital ratio (RBC) declined to 2.68% from 10.27% in the prior year. Regulators require a bank to have a total RBC ratio of 10% to be considered well capitalized.

Bank of the Ozarks did not pay the FDIC a premium for Oglethorpe’s deposits. Bank of the Ozarks agreed to purchase all assets of failed Oglethorpe Bank. The asset purchase by Bank of the Ozarks is protected from loss through a loss-share transaction entered into with the FDIC covering $173.9 million or 80% of the assets purchased.

Oglethorpe Bank is the fifth failed bank acquisition by Bank of the Ozarks over the past year. The four previously completed failed bank acquisitions were Unity National Bank of Georgia in March, Woodlands Bank of South Carolina in July, Horizon Bank of Florida in September and Chestatee State Bank of Georgia in December 2010.

Bank of the Ozarks had received $75 million under the Troubled Asset Relief Program but fully paid back the Treasury in November 2009. Bank of the Ozarks, based in Little Rock, Arkansas, is well capitalized and has $3.2 billion in assets. The Bank has 90 offices in Arkansas, Georgia, Texas, Florida, North Carolina, South Carolina and Alabama.

In a press release, Bank of the Ozarks stated that the acquisition of Oglethorpe would be accretive to earnings. In addition, “the FDIC will reimburse Bank of the Ozarks for 80% of the losses it incurs on the disposition of covered loans and foreclosed real estate. The net assets were purchased from the FDIC at a discount of $38 million. No deposit premium was paid.”

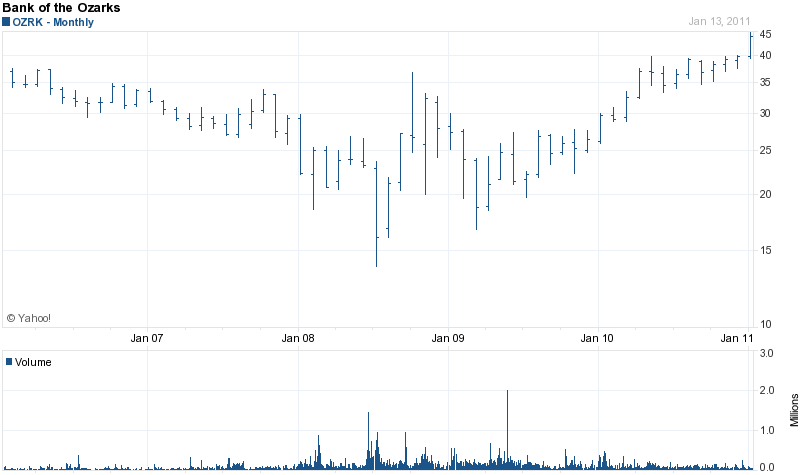

Bank of the Ozarks recently announced record third quarter earnings and a dividend increase. The Bank’s stock has tripled from its low of 2008.

Oglethorpe Bank is the third banking failure of 2011 and the first in Georgia. The cost to the FDIC Deposit Insurance Fund is estimated at $80.4 million.

Speak Your Mind

You must be logged in to post a comment.