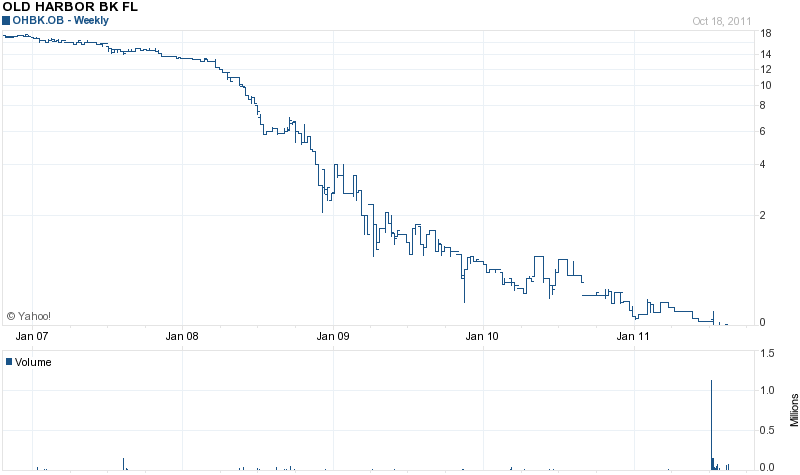

Old Harbor Bank of Clearwater, Florida, an eight year old community bank, was closed today by the Florida Office of Financial Regulation. The FDIC, appointed as receiver, sold the failed bank to 1st United Bank, Boca Raton, Florida.

All seven branches of Old Harbor Bank will reopen on Saturday as branches of 1st United. Depositors will have full access to their money over the weekend through the use of checks, ATM and debit cards.

Old Harbor Bank, founded in 2003, grew rapidly as Florida real estate values and loan demand soared. Competition by other lenders was intense, however, as described by Old Harbor Bank in a letter to shareholders in March 2007. Despite very robust loan growth of 52% during 2006 and a booming real estate market, Harbor Bank lost money.

The Bank faced many challenges during 2006. Among these challenges was an increase in competitive pressures from new community banks that have opened recently, larger regional banks that have entered the market as a result of acquisitions and credit unions. The downward pressure on interest margins experienced in 2005 due to the flat yield curve continued throughout 2006. In addition, the opening of two new offices significantly impacted our operating expenses. Despite these challenges we were able to meet or exceed the goals that we had set for ourselves. We originated over $80 million in loans during the year increasing our net loan balances to $131 million, a $45 million (52%) increase over the previous year…We think that these are quite impressive growth results. On the earnings front, as expected, we had a net loss for the year.

Speak Your Mind

You must be logged in to post a comment.