December 17, 2010 – The Bank of Miami, National Association, Coral Gables, Florida, was closed today by the Office of the Comptroller of the Currency, which appointed the FDIC as receiver. The FDIC sold The Bank of Miami to the lst United Bank, Boca Raton, Florida, which will assume all deposits and purchase most of the assets of failed Miami Bank.

The Bank of Miami had three branches that will reopen on Monday as branches of 1st United Bank. Depositors will have full access to their funds over the weekend and all deposits will continue to be insured by the FDIC.

The Bank of Miami (owned by the holding company, International Bancorp of Miami) had been in business for 46 years as detailed on the Bank’s website.

The significant growth of The Bank of Miami reflects the continuous business expansion of South Florida and its neighboring economies. From a small community bank in South Miami back in 1964, The Bank of Miami has evolved into a strong, multi-faceted, and multi-national financial institution. It is now one of the largest independent banks based in Miami.

Under the able direction of our Board of Directors, the President/CEO and the senior management team, The Bank of Miami has achieved years of impressive earnings and growth.

Highlights include:

- In February 1964, Fidelity National Bank of South Miami is established as a federally chartered commercial bank. Fidelity National Bank changes its name to The International Bank of Miami, National Association in 1980

- In 1985, the bank is acquired by a group of stockholders who retain ownership today.

- In 2002, The International Bank of Miami relocated its headquarters to the prestigious Alhambra Towers, a Coral Gables landmark.

- The Doral branch opened in 2003.

- The International Bank launches its Executive Banking Division in 2006.

- The Medley-West branch opened in 2007.

- In September of 2008, TIBOM officially changes its name to The Bank of Miami, N.A. – to better represent current and future goals of the Bank.

The Bank of Miami was one of South Florida’s oldest, privately-held banks and had prospered until the collapse in Florida real estate values resulted in a large number of defaulted loans and losses for the Bank. The Bank had an astronomical troubled asset ratio of 221% compared to a national average of 15 – banks with a troubled asset ratio of over 100% usually wind up failing.

At September 30, 2010, The Bank of Miami had $448.2 million in total assets and $374.2 million in total deposits. 1st United did not pay a premium to the FDIC for Miami Bank’s deposits and agreed to purchase $442.3 million of the failed bank’s assets, with the remaining assets to be retained by the FDIC. 1st United Bank will be protected from loss on the purchased assets through a loss-share transaction with the FDIC covering $313.5 million or 71% of The Bank of Miami’s assets.

1st United Bank had previously acquired another failed bank, $433 million asset Republic Federal Bank of Miami, Florida, in December 2009. In March 2009, 1st United Bank had received $10 million in funding assistance from the US Treasury under the TARP program but repaid the amount in full in November 2009. 1st United, a billion dollar asset institution, was profitable for the year ending 2009, is well capitalized and recently filed a shelf registration to raise $100 million, if necessary, for future business expansion.

According to 1st United CEO Rudy Schupp, “While we have no definitive plans to raise capital at this time, we believe this registration statement will enhance our ability to quickly raise capital at a later date. We continue to be well positioned to take advantage of both organic and acquisition growth opportunities, and we believe this shelf registration will provide us with added flexibility to access the capital markets, if needed.”

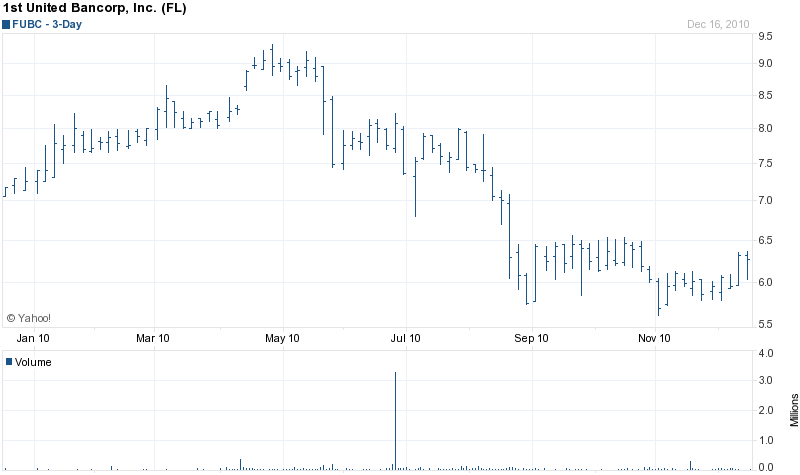

1st United’s stock price has recently declined in line with an overall sell off in bank stocks this year.

The estimated loss to the FDIC Deposit Insurance Fund for the failure of the Bank of Miami is estimated at $64 million. The Bank of Miami is the 152nd banking failure this year and the 29th in Florida, which leads the nation in banking failures.

I hope not to see more bank failures…