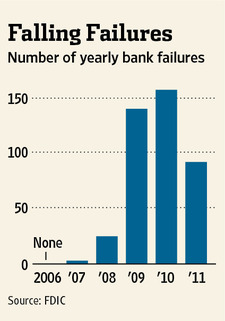

A total of 92 banks failed during 2011, signaling a continuation of the crisis in the banking industry. Although total banking failures during 2011 declined from the previous year, the number remains historically high. The last time more than 50 banks failed in one year was 1992 or 20 years ago.

The complete list of 2011 banking failures is listed below followed by some interesting facts on last year’s banking failures.

| Failure # | Bank | State | Date | Assets $MIL |

||

|---|---|---|---|---|---|---|

| 1 | First Commercial Bank of Florida | Florida | January 7, 2011 | 599 | ||

| 2 | Legacy Bank | Arizona | January 7, 2011 | 151 | ||

| 3 | Oglethorpe Bank | Georgia | January 14, 2011 | 231 | ||

| 4 | Enterprise Banking Company | Georgia | January 21, 2011 | 96 | ||

| 5 | CommunitySouth Bank and Trust | South Carolina | January 21, 2011 | 402 | ||

| 6 | Bank of Asheville | North Carolina | January 21, 2011 | 188 | ||

| 7 | United Western Bank | Colorado | January 21, 2011 | 1,650 | ||

| 8 | FirsTier Bank | Colorado | January 28, 2011 | 782 | ||

| 9 | First Community Bank | New Mexico | January 28, 2011 | 2,300 | ||

| 10 | First State Bank | Oklahoma | January 28, 2011 | 44 | ||

| 11 | Evergreen State Bank | Wisconsin | January 28, 2011 | 247 | ||

| 12 | American Trust Bank | Georgia | February 4, 2011 | 238 | ||

| 13 | North Georgia Bank | Georgia | February 4, 2011 | 153 | ||

| 14 | Community First Bank | Illinois | February 4, 2011 | 51 | ||

| 15 | Peoples State Bank | Michigan | February 11, 2011 | 391 | ||

| 16 | Canyon National Bank | California | February 11, 2011 | 211 | ||

| 17 | Sunshine State Community Bank | Florida | February 11, 2011 | 126 | ||

| 18 | Badger State Bank | Wisconsin | February 11, 2011 | 84 | ||

| 19 | Habersham Bank | Georgia | February 18, 2011 | 387 | ||

| 20 | Citizens Bank of Effingham | Georgia | February 18, 2011 | 214 | ||

| 21 | Charter Oak Bank | California | February 18, 2011 | 121 | ||

| 22 | San Luis Trust Bank, FSB | California | February 18, 2011 | 333 | ||

| 23 | Valley Community Bank | Illinois | February 25, 2011 | 123 | ||

| 24 | First National Bank of Davis | Oklahoma | March 11, 2011 | 90 | ||

| 25 | Legacy Bank | Wisconsin | March 11, 2011 | 190 | ||

| 26 | Bank of Commerce | Illinois | March 25, 2011 | 163 | ||

| 27 | Western Springs National Bank and Trust | Illinois | April 11, 2011 | 186 | ||

| 28 | Nevada Commerce Bank | Nevada | April 11, 2011 | 144 | ||

| 29 | Bartow County Bank | Georgia | April 15, 2011 | 330 | ||

| 30 | New Horizons Bank | Georgia | April 15, 2011 | 110 | ||

| 31 | Nexity Bank | Alabama | April 15, 2011 | 793 | ||

| 32 | Superior Bank | Alabama | April 15, 2011 | 3,000 | ||

| 33 | Rosemount National Bank | Minnesota | April 15, 2011 | 37 | ||

| 34 | Heritage Banking Group | Mississippi | April 15, 2011 | 224 | ||

| 35 | Community Central Bank | Michigan | April 29, 2011 | 476 | ||

| 36 | Park Avenue Bank | Georgia | April 29, 2011 | 953 | ||

| 37 | First Choice Community Bank | Georgia | April 29, 2011 | 309 | ||

| 38 | Cortez Community Bank | Florida | April 29, 2011 | 71 | ||

| 39 | First National Bank of Central Florida | Florida | April 29, 2011 | 352 | ||

| 40 | Coastal Bank | Florida | May 6, 2011 | 129 | ||

| 41 | Atlantic Southern Bank | Georgia | May 20, 2011 | 742 | ||

| 42 | First Georgia Banking Company | Georgia | May 20, 2011 | 731 | ||

| 43 | Summit Bank | Washington | May 20, 2011 | 143 | ||

| 44 | First Heritage Bank | Washington | May 27, 2011 | 174 | ||

| 45 | Atlantic Bank and Trust | South Carolina | June 3, 2011 | 208 | ||

| 46 | McIntosh State Bank | Georgia | June 17, 2011 | 339.9 | ||

| 47 | First Commercial Bank of Tampa Bay | Florida | June 17, 2011 | 98.6 | ||

| 48 | Mountain Heritage Bank | Georgia | June 24, 2011 | 103.7 | ||

| 49 | First Chicago Bank & Trust | Illinois | July 8, 2011 | 959.3 | ||

| 50 | Colorado Capital Bank | Colorado | July 8, 2011 | 717.5 | ||

| 51 | Signature Bank | Colorado | July 8, 2011 | 66.7 | ||

| 52 | One Georgia Bank | Georgia | July 15, 2011 | 186.3 | ||

| 53 | High Trust Bank | Georgia | July 15, 2011 | 192.5 | ||

| 54 | First Peoples Bank | Florida | July 15, 2011 | 228.3 | ||

| 55 | Summit Bank | Arizona | July 15, 2011 | 72.0 | ||

| 56 | Southshore Community Bank | Florida | July 22, 2011 | 46.3 | ||

| 57 | LandMark Bank of Florida | Florida | July 22, 2011 | 275.0 | ||

| 58 | Bank of Choice | Colorado | July 22, 2011 | 1,070 | ||

| 59 | Virginia Business Bank | Virginia | July 29, 2011 | 95.8 | ||

| 60 | BankMeridian, N.A. | South Carolina | July 29, 2011 | 239.8 | ||

| 61 | Integra Bank National Association | Indiana | July 29, 2011 | 2,200 | ||

| 62 | Bank of Shorewood | Illinois | August 5, 2011 | 110.7 | ||

| 63 | Bank of Whitman | Washington | August 5, 2011 | 548.6 | ||

| 64 | The First National Bank of Olathe | Kansas | August 12, 2011 | 538.1 | ||

| 65 | Public Savings Bank | Pennsylvania | August 18, 2011 | 46.8 | ||

| 66 | Lydian Private Bank | Florida | August 19, 2011 | 1,700 | ||

| 67 | First Southern National Bank | Georgia | August 19, 2011 | 164.6 | ||

| 68 | First Choice Bank | Illinois | August 19, 2011 | 141 | ||

| 69 | Patriot Bank of Georgia | Georgia | September 2, 2011 | 150.8 | ||

| 70 | CreekSide Bank | Georgia | September 2, 2011 | 102.3 | ||

| 71 | First National Bank of Florida | Florida | September 9, 2011 | 296.8 | ||

| 72 | Bank of the Commonwealth | Virginia | September 23, 2011 | 985.1 | ||

| 73 | Citizens Bank of Northern California | California | September 23, 2011 | 288.8 | ||

| 74 | First International Bank | Texas | September 30, 2011 | 239.9 | ||

| 75 | The RiverBank | Minnesota | October 7, 2011 | 417.4 | ||

| 76 | Sun Security Bank | Missouri | October 7, 2011 | 355.9 | ||

| 77 | Piedmont Community Bank | Georgia | October 14, 2011 | 201.7 | ||

| 78 | Blue Ridge Savings Bank | North Carolina | October 14, 2011 | 161 | ||

| 79 | First State Bank | New Jersey | October 14, 2011 | 204.4 | ||

| 80 | Country Bank | Illinois | October 14, 2011 | 190.6 | ||

| 81 | Old Harbor Bank | Florida | October 21, 2011 | 215.9 | ||

| 82 | Decatur First Bank | Georgia | October 21, 2011 | 191.5 | ||

| 83 | Community Capital Bank | Georgia | October 21, 2011 | 181.2 | ||

| 84 | Community Banks of Colorado | Colorado | October 21, 2011 | 1,380 | ||

| 85 | All American Bank | Illinois | October 28, 2011 | 37.8 | ||

| 86 | Mid City Bank, Inc. | Nebraska | November 4, 2011 | 106.1 | ||

| 87 | SunFirst Bank | Utah | November 4, 2011 | 376.2 | ||

| 88 | Community Bank of Rockmart | Georgia | November 10, 2011 | 62.4 | ||

| 89 | Polk County Bank | Iowa | November 18, 2011 | 91.6 | ||

| 90 | Central Progressive Bank | Louisiana | November 18, 2011 | 383.1 | ||

| 91 | Premier Community Bank of the Emerald Coast | Florida | December 16, 2011 | 126.0 | ||

| 92 | Western National Bank | Arizona | December 16, 2011 | 162.9 |

Interesting Facts On The Banking Failures of 2011

1. The total losses to the FDIC Deposit Insurance Fund for 2011 bank failures was approximately $7.2 billion. Losses on bank failures since 2008 have totaled $86.3 billion, virtually wiping out the deposit insurance fund which currently insures $6.8 trillion.

2. The FDIC was unable to find buyers for two failed banks, Enterprise Banking Company, Georgia, and Firs Tier Bank, Colorado. The two failed banks had total assets of $878 million which the FDIC was forced to retain for later disposal. The FDIC currently has almost $30 billion in failed bank assets that they are trying to dispose of.

3. Georgia and Florida accounted for almost 40% of last years banking failures. Georgia had 23 bank failures followed by Florida with 13.

4. The 92 banks that failed had total assets of approximately $36 billion. Total assets of banks that failed during the period 2008 to 2010 totaled a staggering $634 billion.

5. The increase in bank failures required the FDIC to almost double its number of employees to 8,129 from only 4,532 in 2007.

6. There were 92 banking failures during 2011 compared to 157 in 2010, 140 in 2009 and 25 in 2008.

7. Seven failed banks had total assets of over $1 billion at the time of closing. The largest bank failure of 2011 was Superior Bank of Alabama which had $3.0 billion in total assets.

8. Losses as a percentage of total failed bank assets was 20%. Prior to failing, many banks carried these assets on the books far above their fair market value.

9. Bank failures occurred in 28 different states. Nevada, which has seen one of the greatest drops in real estate values of any state since 2008, had only one bank failure in 2011.

10. Plunging real estate values and foreclosures have fueled the banking crisis. During 2011, there was a staggering 2.7 million foreclosure filings.

Great article. I quote from your stories often, giving you the credit on the quote.

This was the best wrap-up I have seen of the 50 or more newspaper and other

sources I routinely view for material.

Thanks Kit.