Continuing scandals in the banking industry are making it difficult to avoid the conclusion that the entire crony capitalism structure of banking has become endemically corrupt. Even as the too big to fail banks vehemently lobby against new regulations under the Dodd-Frank Act, recent scandals at Barclays Plc and JP Morgan make it clear that the banking industry can’t be trusted to regulate itself.

Continuing scandals in the banking industry are making it difficult to avoid the conclusion that the entire crony capitalism structure of banking has become endemically corrupt. Even as the too big to fail banks vehemently lobby against new regulations under the Dodd-Frank Act, recent scandals at Barclays Plc and JP Morgan make it clear that the banking industry can’t be trusted to regulate itself.

The derivatives trading fiasco at JP Morgan was barely off the front pages before news of another banking scandal came to light at Barclays Plc, the second largest bank in the United Kingdom. Even worse, as reported by Bloomberg, the scandal at Barclays has resulted in few repercussions for top management despite brazenly lawless conduct associated with the manipulation of the Libor rate.

On June 27, Barclays, the U.K.’s second-largest bank by assets, admitted it deliberately reported artificial borrowing costs from 2005 to 2009. The false reports were used to set a benchmark rate, the London interbank offered rate, or Libor, which affects the value of trillions of dollars of derivatives contracts, mortgages and consumer loans. The bank agreed to pay a hefty $455 million to settle charges with U.S. and U.K. regulators, and on Monday its chairman resigned.

Chief Executive Officer Robert Diamond, who has agreed to forfeit his bonus, shows no sign of following the chairman out the door. He should. In an apology to employees, Diamond wrote that some of the misconduct occurred on his watch, when he was head of Barclays Capital, the investment banking unit. Diamond was already in the doghouse with investors. In April, 27 percent of shareholders, upset that Barclays had missed profit targets, voted down his $19.5 million pay package.

Heads should roll at other banks, too. Regulators and criminal prosecutors, including the U.S. Justice Department, are investigating at least a dozen other firms to determine whether they colluded to rig the rate. Among them: Citigroup Inc., Deutsche Bank AG, HSBC Holdings Plc and UBS AG.

We don’t countenance bank bashing. Nor have we ever called on regulators to bust up big banks. But it’s difficult to defend an industry that defrauds the market with fake interest rate figures, thereby stealing from other banks and customers.

Sadly, the Libor case reveals something rotten in today’s banking culture. We hope the investigations expose the bad actors, lead to jail terms for those who knowingly manipulated the market, and force out the senior managers and board directors who participated in, or overlooked, such conduct.

Why so exercised? In the Barclays settlement documents, regulators released smoking-gun e-mails that reveal the extent of the dirty dealing between bank traders (looking to protect profits and bonuses) and senior officials in bank treasury units (hoping to convince markets that their banks weren’t in financial difficulty).

A Barclays banker responsible for reporting borrowing rates was told to make the bank look healthier by not revealing that borrowing costs had risen. An e-mail he wrote to a supervisor confirms that he complied: “I will reluctantly, gradually and artificially get my libors in line with the rest of the contributors as requested,” he wrote. “I will be contributing rates which are nowhere near the clearing rates for unsecured cash and therefore will not be posting honest prices,” he continued, referring to rates in the overnight money market.

Shareholders of Barclays are infuriated by the latest scandal. In addition to the $455 settlement for the Libor mess, Barclays is potentially facing a fine of $785 million by U.K. tax authorities for evading taxes. Meanwhile, Barclay’s CEO Robert Diamond collects over $6 million per year in pay despite complaints by Barclay shareholders about poor financial performance and excessive compensation for top management.

The cultural mindset at the world’s largest banks has bred an imperial management style under which there is little accountability to either shareholders or the public. Neither the banking crisis, scandals nor a vast array of regulators have been able to fundamentally change the attitudes or conduct of management at the too big to fail banks – expect to see continued banking scandals in the future.

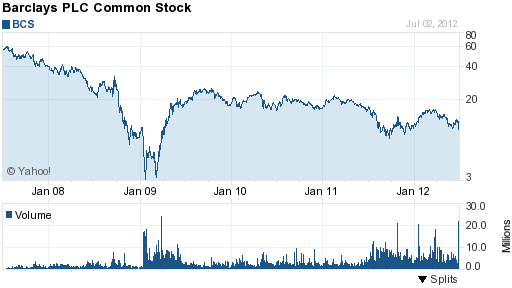

Shareholders, who technically own Barclays Bank are apparently powerless to rein in the massive paychecks of Barclay’s top management (see Ridiculous Divergence Between Bank CEO Pay And Shareholder Returns). A quick look at the stock chart of Barclays illustrates the total disconnect between executive compensation and financial performance. Since 2008, shareholders have suffered losses of 83% while Barclay’s executives continue to reel in huge paychecks. The U.K. Business Secretary, Vince Cable, summed it up best when he said “The public just can’t understand why people are thrown into jail for petty theft and these guys just walk away.”

BCS - courtesy finance.yahoo.com

Late Update: Barclay’s CEO Robert Diamond resigned, effective immediately, in wake of the Libor rigging scandal.

Speak Your Mind

You must be logged in to post a comment.