First Peoples Bank of Port Saint Lucie, Florida, was closed today by the Florida Office of Financial Regulation. The FDIC, acting as receiver, sold the failed bank to Premier American Bank, N.A., Miami, Florida.

First Peoples was a relatively new bank that first opened for business in 1999, promising a “customer driven, community oriented approach” to banking. The Bank rapidly expanded its lending in one of the most overvalued real estate markets in the country. Assets ballooned from $25 million in 2000 to almost $250 million in 2008.

At March 31, 2011, First Peoples had total assets of $228.3 million and total deposits of $209.7 million. Premier American agreed to assume all deposits and purchase essentially all of the assets of First Peoples Bank. The FDIC obtained a value appreciation instrument from Premier American on the sale of the failed bank which allows the FDIC to collect certain payments from Premier depending on the recovery rate of the acquired assets.

With the acquisition of First Peoples, Premier American Bank has now acquired a total of 5 failed banks from the FDIC since 2010. First Premier Bank is a subsidiary of Bond Street Holdings, LLC, Naples, Florida. First Premier gained its banking charter in early 2010 and was established for the express purpose of acquiring failed banks. First Premier raised over $400 million from investors to capitalize the new bank. In the short space of less than two years, First Premier has acquired assets of around $3.5 billion and established itself as a major banking presence in Florida.

First Peoples Bank is the nation’s 54th banking failure of 2011 and the 7th in Florida. The cost to the FDIC for closing First Peoples is estimated at $7.4 million.

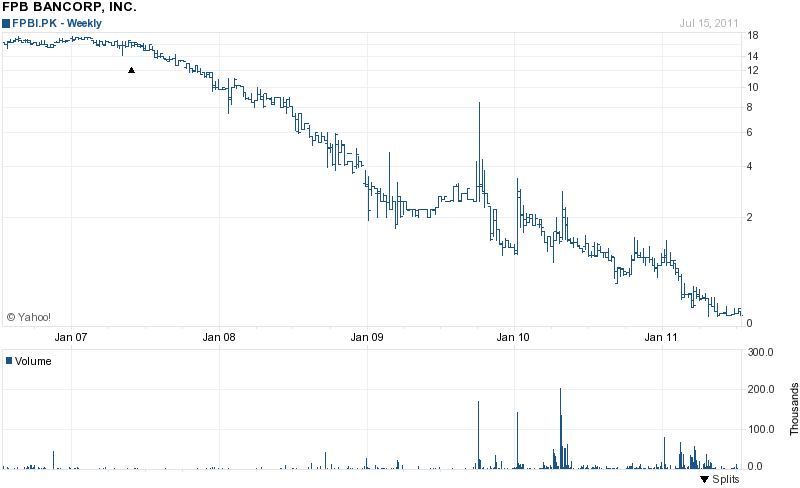

First Peoples Bank was owned by its holding company, FPB Bancorp, a publicly traded company. FPB has declined from $18 per share in 2007 to close today at 12 cents per share.

Speak Your Mind

You must be logged in to post a comment.